There has been talk in the market that the valuation of Seven Group has peaked, prompting discussion about whether now is the right time for the company to raise equity for acquisitions.

Seven Group’s share price has rallied in the past year, buoyed by strong demand for its mining services capabilities due to the booming gold and iron ore demand in Western Australia, with its market value currently $7.93bn.

Sources say that, adding to the theory that a capital raising is on the agenda, is that Seven has been encouraging investors to reconsider how they ascribe value to the company, which is being taken as a signal that it wants an even stronger share price.

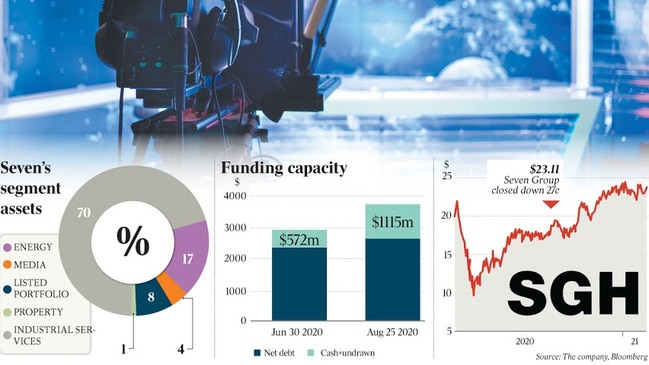

The company had net debt of $2.36bn at June, as it outlaid $435.2m on the acquisition of shares in Boral and Estia and embarked on capital spending for WesTrac and Coates Hire, representing $241.9m.

Market analysts say Seven Group, which owns WesTrac, Coates Hire and stakes in other companies including 40 per cent of Seven West Media, 19.9 per cent of Boral, about 30 per cent of Beach Energy and about 10 per cent of Estia Health, has always said it has room to increase its leverage to four times its earnings and has made no secret of the fact that acquisitions for the right targets are on the agenda.

However, with the share price riding high, some say it is not out of the question that an equity raising is under consideration by the group, which is chaired by billionaire Kerry Stokes and run by his son, Ryan.

After all, the company said in its annual report that it maintains a crisis liquidity buffer to help mitigate any potential COVID-19 impacts or to “take advantage of opportunities as they arise”.

Seven Group reports its results on Thursday, which may be an opportune time to tell the market about any acquisition plans or move to tap the market.

Plenty of targets are said to exist for Seven.

Analysts say it would be keen to acquire the Queensland-based Caterpillar equipment dealer owned by Hastings Deering should it come up for sale, given that Seven currently owns WesTrac, the Caterpillar equipment dealer for NSW, the ACT and Western Australia.

However, until now, the Malaysian owners have not been a seller.

Boral has hired Bank of America for a potential sale of its US business, excluding its fly ash assets, and Seven could be keen to ensure that it has a major say in the outcome involving corporate activity and could be a motivating factor for it to creep further up the register.

If it wants to acquire an additional 3 per cent of the company, as it is entitled to do, additional cash could come in handy for gradually increasing its stake in the $6.2bn business.

An equity raising could also create more of a free float for the listed company.

Shares in Seven Group closed down 27c, or 1.15 per cent, at $23.11 on Wednesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout