While the pharmacy sector has shown some resilience to COVID-19, expectations are that it will not be immune to equity raisings further down the road.

Market analysts are pointing to Australian Pharmaceutical Industries as a contender that could make such a move if the market conditions do not stage an improvement.

Pharmacists make 60 per cent of their revenue from retail sales at the front of the shop.

They have not qualified for the government’s JobKeeper program or, in many cases, rent relief, and sales are said to be down across the industry.

Some believe that the situation may be placing pressure on wholesale pharmacy providers such as API, as its customers try to push out payment terms and its 500-plus pharmacies experience earnings declines, as is the case with other retailers due to the coronavirus pandemic.

However, Priceline and Soul Pattinson chemists in locations with a high level of foot traffic are said to be still trading well and API has ample provisions for bad debts.

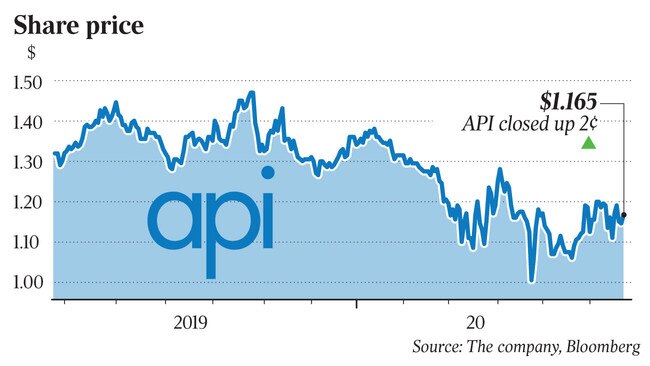

API’s market value is now $564m. That’s a far cry from its 2017 highs.

It has been rolling out its Clear Skin Clinics to provide future earnings growth, given that the pharmacy operations are considered mature.

The seventh community pharmacy agreement recently agreed to by the federal government does offer some extra money for the group.

It also sold stock out of its former takeover target Sigma, netting the company $82m, and suspended its dividend to preserve capital.

Yet API has to spend about $50m to relocate its Sydney distribution centre next year, so whether it needs to raise capital largely depends on the pick-up in revenue in the aftermath of COVID-19.

The stock appeals to retail shareholders that like its dividend payment, another reason why an equity raising could be needed.

Competitor Sigma has no debt and finished its capital spending program, so a capital raising is thought to be unlikely.

Meanwhile, there’s persistent talk that a tie-up between API and Metcash makes sense.

Chemist Warehouse, which has plans for an initial public offering as early as November, is considered a giant when it comes to market buying power in the pharmacy retail space, and some suggest that the only way to compete is to create greater buying power by building scale.

Metcash is understood to have looked at the pharmacy wholesale space before.

It raised $300m in April when COVID-19-weary consumers were rushing to its IGA supermarkets to stock up, pushing up the group’s $2.76bn market value.

The grocery supplier was getting some funds in the door to drive down its bank debt by $292m and gain a major liquidity buffer.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout