QMS Media could be heading back to the listed market sooner than expected, with some suggesting that its owner, Quadrant Private Equity, is looking to put the business back on the block.

Quadrant purchased QMS last year in an on-market scheme of arrangement-style takeover deal for $571.6m.

However, as it has transpired, the timing could not be worse for Quadrant when it came to buying the billboard operator, with the advertising market being decimated earlier this year due to the Covid-19 pandemic.

Yet under Quadrant’s watch, QMS has won some lucrative advertising contracts, and many believe that what is under consideration is a move to spin off the MediaWorks and sports advertising operations to be sold, while selling or listing the core media operations, which is seen as a solid performing business.

QMS owns a 40 per cent stake in New Zealand broadcaster MediaWorks, which it bought from owner Oaktree Capital Management.

MediaWorks is in the process of finalising a sale of its free-to-air television business that includes TV3 and the Bravo channels, to the US-based Discovery Channel.

Many in the market also expect the more successful radio arm of the MediaWorks business, which has the country’s largest stable of radio brands including popular stations such as The Edge, The Rock FM and The Breeze, to also be placed on the block and would likely be sought after by a raft of buyers including the Australian listed Southern Cross Media Group.

Since QMS has been bought out by Quadrant, it has won the ten-year City of Sydney contract from industry heavyweight JCDecaux.

Sources say it is also poised to win the outdoor advertising agreement from Sydney Trains – another contract considered highly valuable.

Understood to be close to the situation is seasoned media banker Michael Stock at Jefferies Australia.

MediaWorks had earlier been on the market through UBS.

Earlier, there was also talk that Quadrant could embark on mergers and acquisitions activity to lift the size and dominance of QMS, with a bid for Australian Radio Network owner HT&E potentially on the agenda.

However, by winning two new lucrative contracts, Quadrant may have already lifted QMS’ value and appeal strongly, and the talk in the market is that it wants to capitalise on that uplift sooner rather than later.

With initial public offering conditions buoyant of late, many believe that this would be Quadrant’s most likely exit strategy.

It is worth remembering that Quadrant had major success with a listing of the Australian outdoor advertiser APN Outdoor.

It floated the business on the ASX for $425m in 2014 after it was purchased for $269m. The business was later acquired by JCDecaux for $1.2bn.

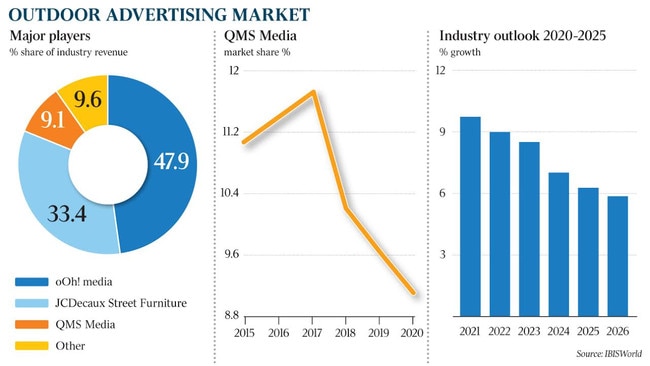

This was part of a round of industry consolidation, where oOh! media also acquired the outdoor operation Adshel from Here, There and Everywhere for $570m.

However, it is also worth remembering that rival private equity firm Kohlberg Kravis Roberts had also been running the ruler over QMS for an acquisition around the time that Quadrant put forward its bid last year.

Other private equity rivals had considered buying QMS in the past and opted to walk away.

In 2018, APN Outdoor was understood to have made a bid for QMS before APN itself was purchased by JCDecaux.

Quadrant has previously built a reputation for lucrative exits on its investments and has traditionally targeted founder-owned companies for acquisitions.

Meanwhile, it is understood that billboard company oOh! Media has recently embarked on a commercial deal with HT&E’s ARN.

HT&E in April emerged with a 4.2 per cent stake in oOh! Media, which was hard hit by the onset of the Covid-19 outbreak early on in the year, and the industry wonders whether such a deal could be a precursor to a merger or takeover plan.

In 2018, APN Outdoor was understood to have offered $1.50 per share for QMS before it was purchased by JCDecaux.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout