Qantas foreign ownership close to selldown trigger

Qantas’s top executives are casting their eyes over the new state-of-the-art Dreamliner in Seattle while the make-up of its shareholder registry is starting to come under scrutiny.

The foreign ownership level of the national carrier is about 48 per cent, terribly close to the threshold of 49 per cent imposed by the federal government.

The controversial ownership cap has long been in place as part of the Qantas Sale Act, and chief executive Alan Joyce has been a vocal proponent of having the measure scrapped.

Under the rules, an automatic selldown must occur if the ownership level by overseas investors is breached and lately international buyers have been pouring into the stock. The government has shown little indication recently that it would consider changing the threshold, so most industry observers and analysts believe the status quo will remain in place.

Qantas’s current share registry shows that its No 1 shareholder is Westpac, which holds 6.6 per cent through its funds management businesses, followed by US giant Blackrock at 6.45 per cent, then UBS, Vanguard, Alliance Bernstein, Manulife and Norges Bank. Domestic fund manager AMP is in 17th place.

After years as a market laggard, Qantas’s share price has taken off in recent months and burst on to the radars of investors around the world.

JPMorgan analysts have reported that the stock’s foreign ownership was at 30 per cent early this year and has increased in line with the stock’s price rise.

In April, Qantas was trading at $3.91 and has climbed steadily to close last night at $6.25.

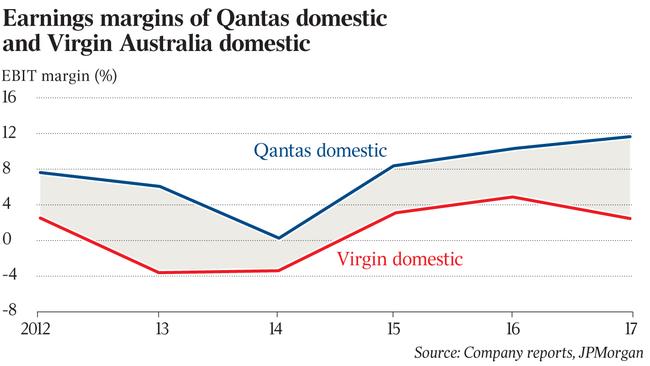

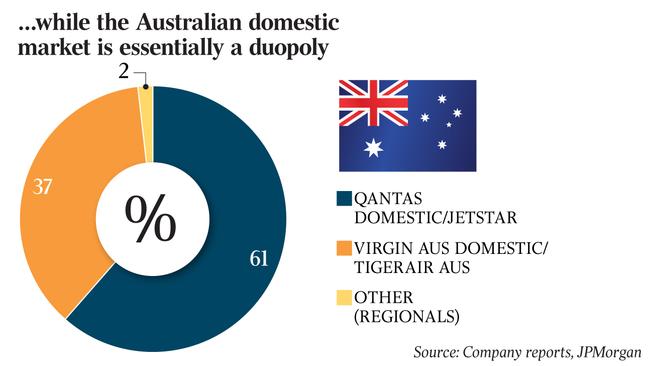

JPMorgan believes a major driver of the stock’s increase in overseas ownership comes from the growing belief that the Australian aviation EBIT margins are on the way to reaching the 15 per cent plus levels seen in the US.

An analysis has shown that EBIT margins of the US full service carriers has American Airlines at 12.6 per cent, Delta 16.8 per cent and United at 14.6 per cent.

Qantas Group sits at 9.9 per cent and Virgin Australia at 3.2 per cent.

But, JP Morgan’s analysts are not convinced though, given the volatile nature of the aviation industry and the chequered history of the major US airlines. The bank said the US airlines had been the beneficiary of much lower fuel costs in the past few years, which had helped the earnings margins of the major players.

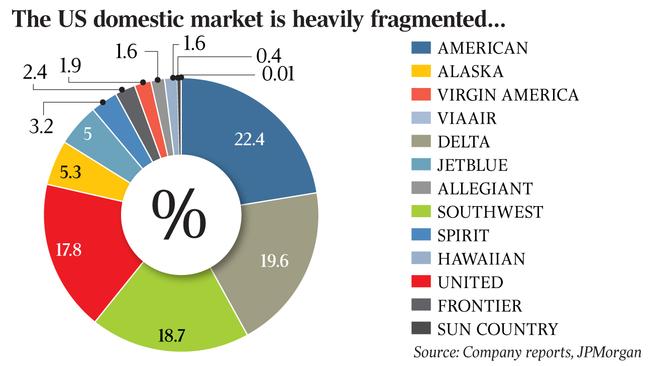

The US carriers also have different depreciation policies along with some fundamental factors that help their margins.

JPMorgan’s research says

the US carriers operate with

a hub and spoke model that allows for higher load factors

and longer routes, which offset the fixed costs of operating airlines.

JPMorgan cut its Qantas recommendation to underweight in August after the profit season.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout