Fund managers have raised doubts over the forecast $1.36bn market capitalisation of Singapore’s loss-making property listings hopeful PropertyGuru, which is aiming for an ASX debut later this month.

Real estate portal PropertyGuru on Monday pushed the button on its planned listing, with which it hopes to raise between $345m and $380.2m.

The tech player is pricing its initial public offering at between $3.70 and $4.50 a share, in a move that values the business at between $1.156bn and $1.364bn.

The Singapore-based online real estate search firm is backed by private equity funds including TPG Capital and Kohlberg Kravis Roberts. Working on the float are investment banks Credit Suisse and UBS.

But with PropertyGuru yet to turn a profit and battling at least six rivals in the regulated Singapore real estate market, fund managers have questioned the valuation. One fund manager on Monday described PropertyGuru as “two times overvalued”. A second raised doubts over the financial track record of the business.

The company will sell between 93.3 million and 84.5 million chess depositary interests, which are equivalent to shares, in a deal in which between 29.8 per cent and 27.9 per cent of the overall business is sold to new investors.

The group’s enterprise value will be between $1bn and $1.2bn, equating to between nine times and 10.9 times its revenue for the 2020 financial year.

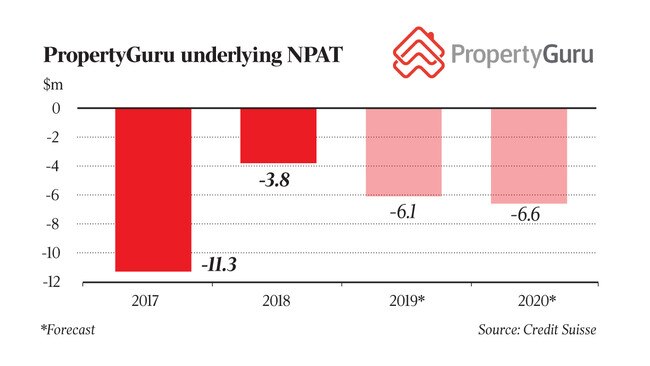

Brokerage Credit Suisse has forecast PropertyGuru to deliver an underlying net loss of $S6.1m ($6.6m) this calendar year and a loss of $S6.6m next calendar year.

“After taking into account share-based expenses and given the majority of PropertyGuru’s operations remain at a fairly early stage of investment (particularly outside of Singapore) the company is expected to generate an NPAT loss over the near term,” Credit Suisse said in a recent pro-IPO research note.

PropertyGuru has been described as one of Singapore’s largest online property portal groups, and earlier valuation estimates from analysts suggested the business was worth up to $1.2bn.

The analysts’ value range equated to between 9.7 and 10.8 times its fiscal 2020 revenue. That received a lukewarm response from investors, who believed the company was overpriced.

Expectations had been that the group would raise about $300m, but whether it proceeds with a float is expected to partly depend on the success of the Latitude Financial IPO.

Another point of criticism has been that PropertyGuru faces competition, including from iProperty, which is owned by the ASX-listed property listings major REA Group. News Corp, publisher of The Australian, has a majority stake in REA.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout