Australian listed property companies are believed to be getting their succession planning in order as the search continues for a new chief executive at Stockland.

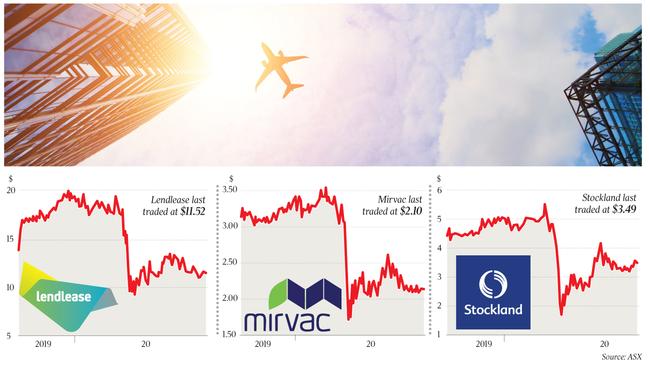

The $7.8bn diversified developer and investor Lendlease held a board meeting last week, and it is understood that one of the topics that was up for discussion was who would succeed Steve McCann as the group’s chief executive when he steps down.

Speculation had surfaced last year that Mr McCann might be not far away from making a departure from Lendlease after almost 12 years at the helm, and that the company’s Australian head Kylie Rampa was the candidate in line for his role.

Other possibilities include internal candidates Denis Hickey, who is the chief executive of the Americas, and Tony Lombardo, head of Asia.

It is understood that Lendlease is now paying greater attention to succession planning as its $8.46bn rival Stockland scans the market to find a replacement for outgoing boss Mark Steinert, who has been in the job for seven years.

There had been talk in the market that Ms Rampa could be in Stockland’s sights for managing director.

One line of thought is that if the Lendlease board has her in mind to take over from Mr McCann, it may be keen to lock in the succession arrangements now in order to retain the executive.

Other top Lendlease executives may also be in line for the job. Another Australian listed real estate group where the board members are thought to have succession at the forefront of their minds is Mirvac.

Managing director Susan Lloyd-Herwitz has been in the role since 2012 and top Mirvac executives could also be on the Stockland chief executive shortlist.

These include Campbell Hanan, who is head of office and industrial at Mirvac, and Brett Draffen, Mirvac’s head of development.

Stockland has hired Egon Zehnder to find Mr Steinert’s replacement.

They have some time, given he is to step down once his replacement begins in the job and serves a transition period.

Internally, the strongest candidate to take the role is considered to be Andrew Whitson, who is Stockland’s group executive and communities chief executive.

Whoever succeeds current chief executives among the major Australian listed real estate groups will no doubt have their work cut out for them, as the challenging COVID-19-impacted environment continues to wreak havoc with property valuations.

Rising unemployment, social distancing, a decline in consumer spending and a weak economic outlook are all expected to impact the earnings of office tower, shopping centre and logistics groups.

The understanding is that Mr Steinert, who had a long banking career before his Stockland days, will retire to Noosa.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout