Telus International’s efforts to buy Appen have turned out to be short lived, with its walking away from an initial $1.2bn buyout proposal this week.

Now the question is whether shares fall further and a private equity firm that is said to have been looking at the business turns up down the track offering an even lower price.

Appen announced on Thursday that it had received a $1.2bn buyout proposal from the Canadian company and that it was to provide it some financial information while trying to negotiate a higher price.

Then, only hours later, it entered a trading halt before telling the market that Telus had dropped its proposal to buy the business for $9.50 per share without an explanation.

All this while releasing a sobering profit downgrade indicating that its earnings will be materially lower than in the previous corresponding period.

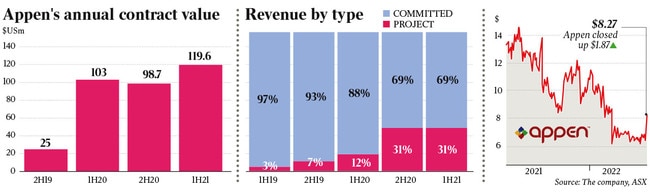

Appen is a data sourcing company that achieves about 85 per cent of its revenue from major tech giants like Facebook owner Meta, which have been cutting costs on the back of their own deteriorating results.

Some on Thursday were suggesting that Appen should have taken the Telus offer at $9.50 per cent with a deteriorating environment up ahead for tech stocks.

Telus was working with Rothschild and Barrenjoey shareholder Barclays on the takeover while Appen was working with Barrenjoey Capital, Atlas Technology Group and law firm Allens.

The situation has striking resemblances to the Brambles situation last week, where the company announced it had received a $20bn buyout proposal from private equity firm CVC, only to tell investors the next day that CVC had walked away.

Shares in Appen have dramatically fallen from 2020 in the pandemic, when they were close to a $40 high, to $6.40 on Wednesday, equating to a market value of $790m.

The $US6.35bn New York-listed Telus designs, builds and delivers next-gen digital solutions for global and disruptive brands, providing IT services and multilingual customer service to global clients.

Appen, run by Mark Brayan, provides or improves data used for the development of machine learning and artificial intelligence products, including speed and natural language data, image and video data, text and alphanumeric data and relevance data to improve search and social media engines.

It listed in 2015 with a $47.3m market value.

Appen surged to an eye watering valuation of more than $40bn amid the global pandemic in 2020 when much of the world was in lockdown to curb the spread of Covid-19 and low interest rates were fuelling investment.

Tech stocks have since heavily sold off and private equity firms and other opportunistic buyers are currently trawling the Australian listed market in search of buyout opportunities.

James Nicolaou, senor investment adviser at Shaw & Partners,

In November 2020, Telus purchased translation expert Lionbridge for $US939m which equated to 21 times its earnings before interest, tax, depreciation and amortisation including debt.

Based on the same multiple for Appen, Telus would need to pay an equity value of about $1.7bn which is about 40 per cent higher than Appen’s current implied equity value, said Shaw & Partners senior investment partner James Nicolaou.

He said given Appen’s downgrade, the company had no leverage with a buyer.

Technology stocks have sold off aggressively in the past six months and private equity has been capitalising, with Infomedia and Pushpay receiving bids from TA Associates and BGH Capital respectively in the past fortnight.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout