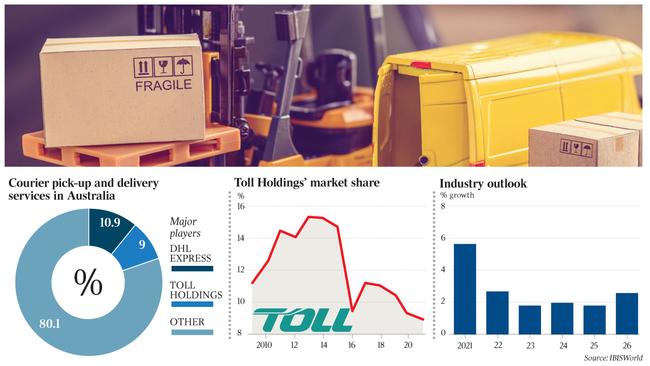

The sales process for Toll’s $3.5bn Express division has officially kicked off and the contest is shaping up to be a battle between private equity funds.

DataRoom understands that among the groups lining up for the business are Pacific Equity Partners, BGH Capital and Anchorage Capital Partners.

The successful buyer will no doubt have its work cut out when it comes to turning the division into a strong performer, but it could pay major dividends for any group willing to steel itself for the challenge.

It is understood suitors received an information memorandum in recent days. This was in conjunction with management consultant reports.

The first round bids are due before the end of the year in the sales process run by Nomura and JPMorgan.

All of the major private equity funds, such as Kohlberg Kravis Roberts, Brookfield, Blackstone and Carlyle and TPG Capital, have been sent documents for the sales process. Some think the contest will boil down to bidders that are either industry competitors or private equity firms more focused on turnaround opportunities.

Anchorage focuses on turnaround situations, although depending on the level of interest it could be outbid in the contest if larger funds step up, given it typically buys businesses for less than $500m.

BGH recently lined up to buy Virgin Australia after the airline collapsed and the auction for the carrier was won by Bain Capital’s $3.5bn proposal.

Some believe that private equity firm Platinum Equity is likely to take a look.

Platinum purchased Sensis, which owned the Yellow Pages directory, from Telstra in 2014.

Also worth watching is US logistics industry giant FedEx, which owns TNT, although it may face problems with the competition regulator.

Australia Post would also be a logical buyer, but could run into competition concerns.

The other group to watch is Singapore Post, which has been making efforts to break into the local market to compete with Australia Post and Toll.

It already owns a number of courier companies, including Couriers Please, which it purchased from New Zealand Post in 2014 for almost $100m.

Singapore Post bought a 30 per cent stake in Hubbed, an Australian company that arranges parcel deliveries and returns using a national network of more than 680 newsagents.

Any foreign group completing a deal would need to obtain Foreign Investment Review Board approval.

It is understood Toll wants to sell the division in one line.

Toll was founded by Australian billionaire Paul Little and is owned by Japan Post, which outlaid $6.5bn for the operation in 2015, and Global Express is its parcels arm.

The Japanese company booked a shock $4.8bn writedown on Toll two years later. It has since invested $2bn in Toll but a goal for it to be cashflow-positive by April was not met.

Industry sources say the company was heading for collapse earlier this year, but Japan Post was not keen to sign off on a move to place the business into voluntary administration — one that would leave it with heavy redundancy and closure costs.

While COVID-19 has meant online trade has been booming, Global Express has suffered from volatility and cyber attacks.

It lost $100m in the June quarter, which may deter some bidders, but Toll says earnings for the division improved by $80m in the September quarter.

Toll’s two other divisions, logistics and forwarding, will remain under Japan Post’s ownership. Chairman John Mullen earlier said a decision to proceed with a sale of Global Express had been brewing for some time.

The logistics assets with exposure to the resources industry were earlier thought to be appealing to Qube.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout