Only weeks after launching one of the largest equity raisings of the year, Ramsay Health Care has become a talking point in the mergers and acquisitions space over what will be its next target, with some wondering if it will start to close in on the £1.2bn ($2.2bn) Priory Group healthcare business in Britain.

Ramsay made no secret of its aspirations to buy more businesses as it went cap in hand to investors for $1.4bn in April.

It is known to have been considering Icon Care in Australia and Everlight Radiology, which is still on the market.

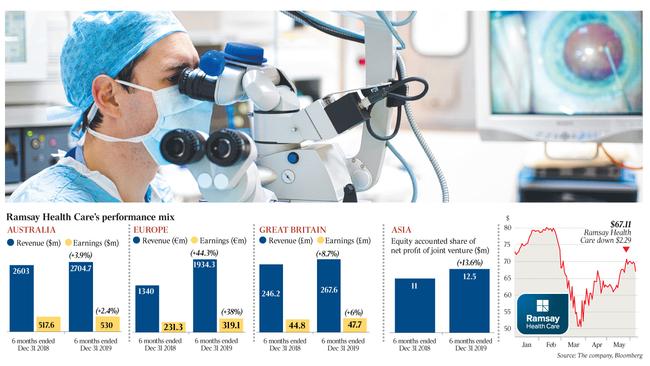

But some believe acquisitions overseas, where it already operates in Britain and Europe, offer the best avenues for growth, with the number of people taking out private health insurance in Australia on the decline for some time, putting pressure on profit margins for private hospital providers.

Priory is Britain’s largest mental health provider with 361 centres throughout the country, but it is known for its flagship Roehampton hospital in London, where rich and famous patients receive treatment at its addiction clinic, which has already treated the likes of Amy Winehouse, Kate Moss, Johnny Depp, Robbie Williams and Paula Yates.

Ramsay in the past year has put in a bid for the business, with British reports suggesting it was backed by European private equity firm CapVest.

Its offer rivals one from the German hospital operator Schoen Clinic, partly owned by The Carlyle Group.

The sales process was placed on hold in March as the country grappled with the COVID-19 outbreak, but owner Acadia said as recently as last week that the halt to the sale process was temporary.

Ramsay is now cashed up and in a strong position with plenty of firepower.

The services provided by Priory sit nicely within Ramsay’s area of expertise, with the Australian private hospital provider founded by Paul Ramsay starting out as a business offering mental health services.

Priory has attracted interest from private equity firms such as Kohlberg Kravis Roberts and Brookfield, as well as Carlyle, but strategic buyers such as Ramsay typically have a price advantage over buyout funds.

Acadia Healthcare bought the business in 2016 from Advent International for more than £1.2bn and merged it with Partnerships In Care.

A sales process was launched last year through advisory firm Rothschild in response to inbound interest.

The price tag is expected to be more than £1bn and some wonder whether that cheque would be too large for Ramsay, although the group has a market capitalisation of nearly $16bn.

When Ramsay launched its equity raising in April through JPMorgan, it indicated that the funds would be used to create a war chest to accelerate its out-of-hospital growth strategy and become a fully integrated hospital company.

Chief executive Craig McNally said at the time that the company wanted to broaden its service profile.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout