US-based private equity firm Platinum Equity is understood to have hired KordaMentha as part of its efforts to buy Toll’s Global Express unit, with final bids due on Wednesday.

Platinum’s Singapore-based executives have recently entered the country to examine the unit, which has faced challenges remaining profitable of late.

As well as KordaMentha, Gresham has been assisting Platinum.

Platinum is going head-to-head with Allegro Funds Management in the JPMorgan and Nomura-run contest.

Allegro is advised by McGrath Nicol and law firm Herbert Smith Freehills.

The fact that both final contenders are working with insolvency firms indicates the challenges that lie ahead for them with respect to turning the company around.

Yet the rewards could be great for a company prepared to make the tough decisions needed to return the business to profitability.

Turnaround opportunities are the sweet spots for both Allegro and Platinum.

Platinum sold the Australian Yellow and White Pages owner Sensis this year for a reported $250m to US-based Thryv in what has been described as a management buyout deal.

The private equity firm bought Sensis for about $454m in 2014 and has been winding it down over time while collecting its cashflow along the way.

Given that investment was highly successful for the group, sources say it remains on the hunt for another acquisition in Australia. Platinum has been relatively quiet in this part of the market of late, with one of its most recent acquisitions being the Australian and New Zealand arm of office supplies business Staples in 2018.

The company has since been rebranded Winc.

Allegro has a track record of taking on difficult operations.

When it purchased the Australian general merchandise division from the cash-strapped Steinhoff International in 2019, it controversially placed the Harris Scarfe division into administration only weeks after the deal.

Harris Scarfe was later sold to the Spotlight Group.

The Sydney-based buyout fund, which focuses on turnaround situations, is also embarking on an initial public offering of Best & Less Group, which it secured in that Steinhoff acquisition.

Selling apparel and homewares, its brands include Best & Less and Postie in New Zealand.

The understanding is that both parties are bidding for the entire unit after contenders for parts of the operation were knocked out.

The Global Express division consists of express parcels, pallets, intermodal, the Toll freight shipping operations to Tasmania, an intermodal operation and a New Zealand division.

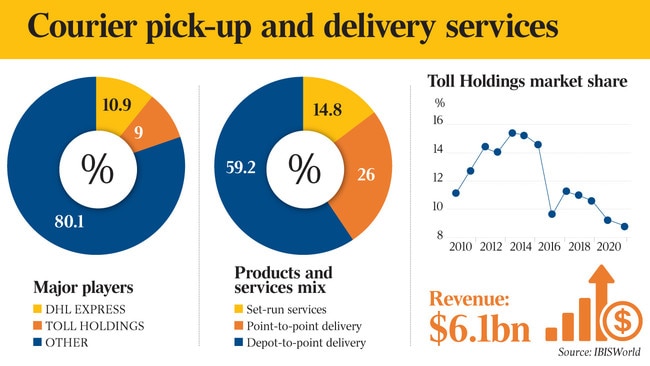

Japan Post outlaid $6.5bn for Toll in 2015.

The Asian logistics group has had challenges with the well-known Australian company ever since.

It later booked a writedown on its investment worth $4.8bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout