Pet Circle has hired advisory firm Greenhill as part of an effort to inject capital into the pet supplies company in a move that could see it valued at about $1bn.

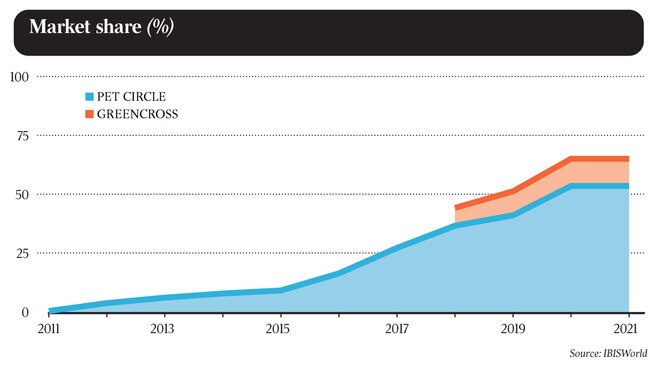

The Australian online pet supplies company is based in Sydney and was founded by Mike Frizell and James Edwards in 2011.

It is understood to be generating about $100m in annual revenue.

Popular online retailers are selling for as much as 10 times their sales, which could put its value at about $1bn.

It is understood that investment bank Greenhill & Co has been making introductions on behalf of the company to funds as part of what is known as a ‘Series C’ raising where further primary capital is injected into the business.

The move has some questioning whether a sale of the business could also soon be afoot.

Pet Circle was initially called Paws for Life when it was founded and after a $4m capital fund raising, the company tripled its warehouse operations and expanded its product range.

Between 2013 and 2015, the company grew by over 300 per cent.

It has relied on venture capital funding to expand its operations.

In January 2017, Blue Sky Alternative Investments sold its stake in the business to AirTree Ventures that it purchased in 2013.

AirTree and global private equity firm Francisco Partners made growth equity investments in the company in November 2017.

On its website, the company describes itself as Australia’s largest online pet shop with exclusive brands such as Paw & Spoon, Nature’s Cuts and Paws for Life.

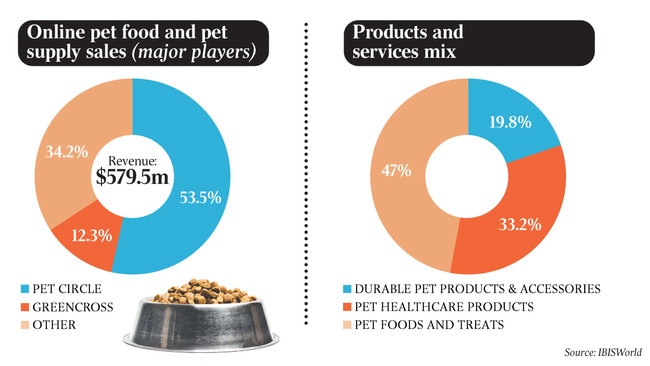

The business has 53.5 per cent of the online market share in Australia ahead of Greencross with 12.3 per cent, according to IBISWorld.

Fuelling the industry has been rising discretionary incomes and the record number of pet adoptions that occurred as housebound consumers sought out companion animals during lockdown restrictions, says IBISWorld.

Revenue is anticipated to rise by 19.2 per cent in the current year and industry revenue is forecast to increase 7.8 per cent annually over the five years through 2025-26 to $845.5m.

New Zealand’s premium pet food company ZiwiPeak is also looking to capitalise on the booming conditions.

Nestle, The Carlyle Group and Kohlberg Kravis Roberts are all said to be taking a look at the $1bn-plus business that generates about $50m of annual underlying earnings.

Greencross is said to be doing a roaring trade amid the global pandemic – making substantially more than the $100m of profit it was generating when it was purchased by TPG Capital – and the US-based buyout fund has recently been considering an exit for the business.

After buying the listed Greencross in 2019 for close to $1bn including debt, it is understood that the asking price is now about $4bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout