Panoramic Resources hires Azure Capital to help stop Independence takeover

Panoramic Resources is gearing up for a fierce battle to stave off a $312m takeover offer from larger rival Independence Group by drafting in West Australian-based Azure Capital as its adviser.

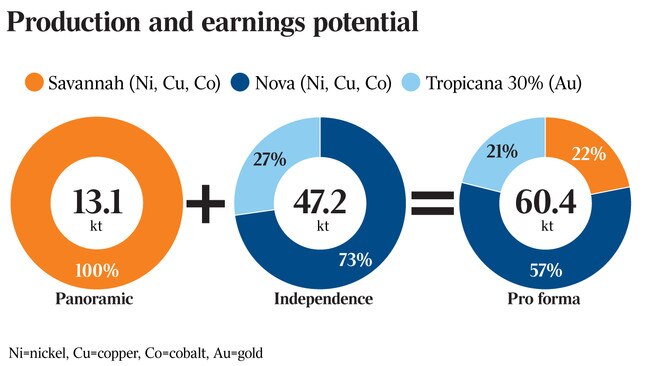

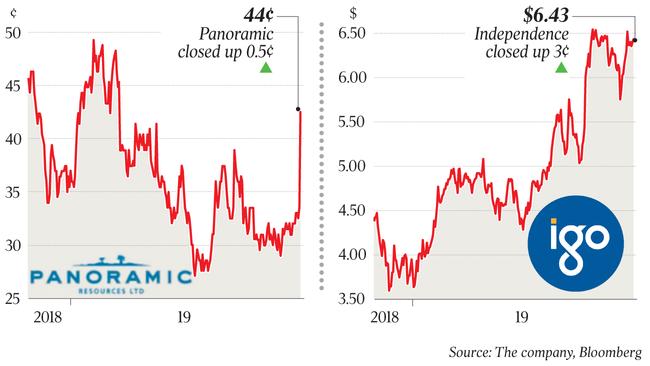

The appointment was set to be finalised on Wednesday and was first revealed by DataRoom online. It comes after Independence Group offered Panoramic holders one share for every 13 Panoramic shares on issue on Monday. Based on its average share price trade over a month, the Independence offer values its target at 47.6c a share — a 42 per cent premium to its 33.5c closing price on Friday. On Wednesday, the offer was worth 49.37c a share, or $323m.

Working with Independence Group is investment bank Citi and law firm Herbert Smith Freehills. The all-scrip move on the nickel producer was first flagged in DataRoom last month and shares in Panoramic continue to trade higher.

The situation has turned hostile after Independence has made unsuccessful attempts to engage with Panoramic in the past about an acquisition.

The hope for Independence has been to exercise due diligence before pursuing an acquisition, prompting the firm to make the takeover subject to due diligence.

A concern for Independence is the performance of Panoramic’s Savannah nickel sulphide mine in WA’s Kimberley Region, which the target has struggled to return to production after its 2016 closure.

The understanding is that Independence wants to know what it is buying before merging the company into its operation.

Independence is arguing that Panoramic shareholders will be part of a larger, more diversified and liquid vehicle. The likely strategy for Independence is that institutional shareholders will be keen for a deal and therefore place pressure on Panorama’s directors to allow due diligence.

Much of whether Independence gains complete control of the company rests on Zeta Resources, which controls 34.73 per cent of the target, and some think the situation may put pressure on Zeta to name its price to sell out of the company. But Independence could still gain more than 50 per cent of the company without Zeta’s blessing.

The bidder’s statement is expected to be released to the market on November 18 or 19.

Independence has been circling Panoramic for some time, taking a 3.8 per cent stake in the business during an emergency capital raising in September, its second this year.

The bid may bring back memories for some in the resources space of the attempted takeover by US hedge fund MatlinPatterson of Anaconda Nickel in 2002. The fund made a highly conditional bid that ended up with the Takeovers Panel.

It ended up as a large shareholder of the company after the Takeovers Panel offered a ruling that neither allowed or disallowed the deal to proceed, saying the hedge funds had the right to make such an offer, but Anaconda had no obligation to accept it. Panoramic advised shareholders to take no action on the Independence bid, saying it would consider the offer.

Western Areas has also eyed a tilt at Panoramic, as revealed by The Australian on Monday.

Independence is eager to buy the business as it remains keen to strategically focus on metals critical to clean energy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout