Deal activity is believed to be afoot in the food and beverage sector, with two producers of white label products thought to be potentially for sale.

There is also talk of a major upcoming divestment brewing involving a food and beverage company that is worth up to $1bn.

DataRoom understands that Vesco Foods has been on offer to buyers in the past and may be soon coming onto the market, although it is not currently on offer, as is the case with beverage company Tru Blu.

Meanwhile, there is speculation mounting of a potential divestment by The Kraft Heinz Company of its Golden Circle business, although the company says it is not for sale.

It comes as two of the Australian-based private equity groups – Pacific Equity Partners and Quadrant Private Equity – are soon expected to put their respective food manufacturing companies, Patties Foods and Darrell Lea owner The RightBite Group, on the market within the next year.

PEP’s Patties, along with Australian food producer SPC are seen as the logical acquirers of Vesco, which specialises in frozen meals in the private label space.

Some estimate that the company could be worth between $300m and $400m.

Tru Blu, meanwhile, is owned by Sydney-based Peter Brooks and is also thought to be worth several hundred million dollars.

The company sells branded products as well as contract-packed beverages and says on its website that one in six beverages purchased by Australian consumers are made by the company.

Its brands include Riviera, Glee, Pub Squash, LA Ice Cola and FruitCo among others.

It also produces Waterfords water products.

Tru Blu is also the largest manufacturer of contract-packed beverages sold through Australian supermarkets including Coles, Woolworths, IGA and Aldi.

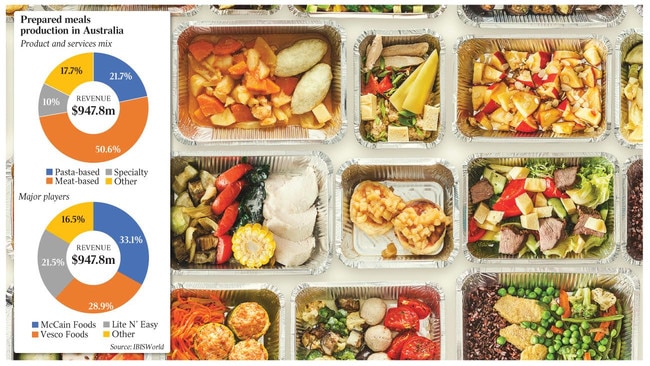

Vesco, meanwhile is based in Western Australia and supplies meals to the Australian, Asian and the Middle Eastern markets and is behind brands such as Lean Cuisine, Super Nature, On the Menu, Annabel Karmel and Clever Cuisine among others.

The company was purchased by private equity firm Cataylst in 2013 and merged with Queensland-based Prepared Foods Australia, which manufactures frozen food products for the health sector.

Details of companies in the food and beverage space are hitting the desks of prospective buyers after industry players have experienced strong supermarket sales amid the pandemic.

However, parts of the industry reliant on events and service station sales have also been hard hit as shoppers opt to stay home.

A challenge for buyers will be to estimate earnings forecasts for groups amid such volatility.

Kraft Heinz is being closely watched by prospective private equity buyers in Australia after the US-based company was said to have mulled an exit from the local market in the past two years.

However, for now, sources say that Golden Circle, which produces juices and also canned pineapple and beetroot products, is the most likely business to be divested.

The question surrounding the business that is worth several hundred million dollars, is what parties would be the buyers.

The US multinational purchased the business from Anchorage Capital Partners in 2008 for a price reportedly valuing the food and beverage producer at about $288m.