Mercer joins the action on Insignia Financial

A three-way takeover battle is already playing out for Insignia Financial, and now there’s even more weighing in on the action.

A three-way takeover battle is already playing out for Insignia Financial, and now there’s even more weighing in on the action.

Healthscope remains in the emergency room, but HMC Capital’s backer and industry groups want to offer the hospital provider a lifeline.

The student accommodation provider has suspended its sale as owners weigh up what is next for the business.

Vulcan Steel has signalled it intends to seek out “new opportunities” to expand its footprint in Australia, and is eager to explore acquisitions.

There’s talk Star Entertainment once again has an equity raising on its agenda.

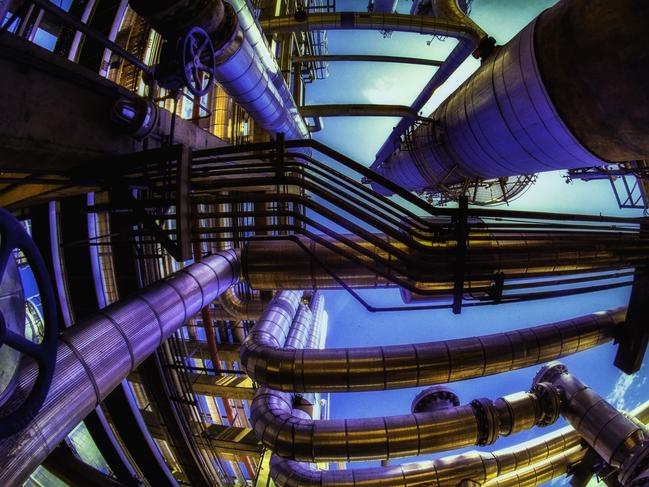

Buyers like Beach Energy and GLNG are tipped to circle Westside Energy’s stake in the Meridian gas plant.

Despite its share price trading at all-time highs, Qube is unlikely to buy an increased share in the Patrick stevedoring business.

Rural services companies with an interest in Incitec Pivot’s fertiliser business are expected to be somewhat sidelined in the sales process.

Reporting dates for Ingenia and Lifestyle Communities are creating suspicions the retirement home operators could be working out a deal.

First round bids have landed in one of the country’s hottest real estate auctions run by Barrenjoey and Morgan Stanley.

Investment bankers have recently entered a beauty parade in the hope of landing the job of selling the pet food company.

Blackstone weighed up another bid for the real estate and infrastructure group last year, and now its major private equity rival is said to have been looking.

Pacific Equity Partners has high hopes a suitor will come forward with a generous offer for its renewable energy specialist.

The Ravenswood gold mine in Queenslad is up for sale through EMR Capital and Golden Energy and could fetch up to $2bn.

Aspirations by China’s State Grid to buy Jemena are understood to have put an end to a possible sale of the energy business.

Bain Capital is closing in on its next big target struggling with too much debt – the country’s second-largest hospital operator Healthscope.

Potential bidders have been given information about Incitec Pivot’s fertiliser unit, but the jury’s still out as to how much they will be prepared to pay..

Rivals with stagnant share prices and CSG developments are on the acquisition agenda for the Kerry Stokes-backed energy group.

Centuria Office Fund’s share price reflects high office vacancies in city fringe markets, a weak economy and working from home – but buyers could soon move in on Australian REITs.

As Orora’s share price has declined, speculation has risen whether it could be back in the crosshairs of private equity suitor Lone Star Funds.

Speculation is growing that Jo Horgan’s beauty retail phenomenon Mecca Brands may find its way to the market with a valuation of well over $1bn.

It’s now a three-way contest, but the question is will it result in a privatisation or another wealth management deal elsewhere?

An Australian Government Bond issue has drawn an extraordinary $76bn in demand.

The owner of the Freedom Furniture and Fantastic Furniture chains, Greenlit Brands, has moved into profitability and is now better placed for a potential trade sale or listing.

Fresh from striking a deal to buy part of Kiwi investment bank Craig’s, private equity firm TA Associates is back on this side of the Tasman hunting for more opportunities.

A banker from rival Goldman Sachs is being touted as a potential candidate for the top role at Citi’s Australian investment banking operations.

The $1bn-plus sale process for the non-bank lender Scottish Pacific is yet to start in earnest, but there’s one party that has already been at least kicking the tyres.

There’s talk that the New York-based private equity firm is once again having some serious conversations in the background about taking over Star Entertainment.

The packaging maker remains in focus, but Amcor and BlueScope could be winners from the changes.

A property development demerger, an exit from Australia and a move to have just a few business units are all possibilities under chairman Peter Crowley.

Original URL: https://www.theaustralian.com.au/business/dataroom/page/7