Why Affinity Equity is paying up for Healius imaging

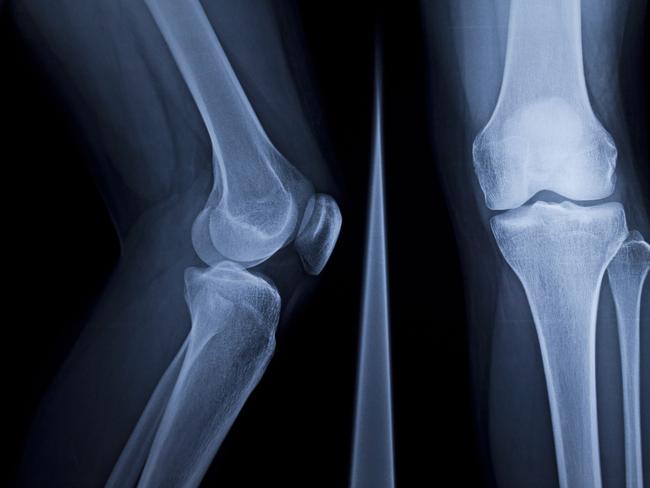

Healius becomes a pure play pathology provider after selling off its diagnostic imaging business for $965m, securing $800m in net proceeds.

Healius becomes a pure play pathology provider after selling off its diagnostic imaging business for $965m, securing $800m in net proceeds.

Advisers working for the $6bn listed Incitec Pivot have again been sounding out prospective buyers for the company’s fertiliser operation.

Star Entertainment is keeping investors on edge, with trading in its shares halted pending a future announcement.

Fletcher Building’s advisers were working at the weekend to raise $NZ700m at $NZ2.40 a share for the cash-strapped group.

Affinity Equity Partners is understood to have lobbed a strong final offer.

Fresh from striking a $24bn deal to sell the Airtrunk data centre giant it co-owned, Macquarie Asset Management is understood to have turned its attention to New Zealand

Poultry business ProTen is on the block through its owner Aware Super and Roc Partners is in prime position to snap it up for up to $1bn.

Investors are being talked through the reasons why they should buy shares in a Cuscal float in one-on-one meetings.

A block trade involving Auckland Council shares out of Auckland International Airport could soon be in flight.

Kerr Neilson has been keen for an exit from Platinum Asset Management but is the mooted deal with rival Regal Partners what he really wants?

Japan’s Mitsui is understood to have lobbed a low-ball offer for Mineral Resources’ onshore Perth Basin assets, prompting the Chris Ellison-backed company to run an auction.

The owner of brands including Rivers, Katies and Autograph is on life support as it battles tough economic conditions.

Affinity Equity Partners appears well placed to buy Lumus Imaging, taking on contest favourite TPG Capital Partners and PEP with a final bid worth about $700m.

There’s talk in the market again about a deal involving Ramsay Health Care, with a private equity firm said to be pulling together a management team to run the business.

Charter Hall Retail REIT is unlikely to make a higher offer for Hotel Property Investments even though a price well over $4 a share is needed to get a transaction over the line.

Regal’s bid for Platinum looks highly opportunistic, but it may be just the start of negotiations.

The future of the country’s second-largest casino operator may be hanging in the balance, but lenders have offered it a lifeline.

Australian firms looking to list this year need to hit the IPO runway now if they can make a deal happen by Christmas.

Australian listed miner IGO is understood to be weighing the acquisition of one of Rio Tinto’s assets in Western Australia.

Block trades keep coming thick and fast as the ASX approaches record highs, and the latest is Odyssey Investment Partner’s 9 per cent stake in $3.5bn listed insurance broker AUB.

Original URL: https://www.theaustralian.com.au/business/dataroom/page/16