Nufarm sells South America business for $1.18bn

Shares in agricultural chemicals company Nufarm surged to a sixth-month high on Monday after the company said it would offload its South American operations to Sumitomo for $1.18bn and use the case to ease its debt burden.

Nufarm is in a net-debt position of almost $1.3bn, with a gearing ratio of about 34 per cent and a leverage of three times its underlying before-tax earnings, even after raising $296m at $5.85 per share in October 2018.

It has finance facilities worth $498.1m due for repayment within a year.

Nufarm reported a statutory net profit after tax $38.3m for the 2019 financial year on Monday, including individually material items of $51m, compared to a loss of $16m the previous year.

But the company said it will use the proceeds of its asset sale to repay some of its debts, flagging a leverage of 0.7 times its underlying earnings when the deal closes later this year.

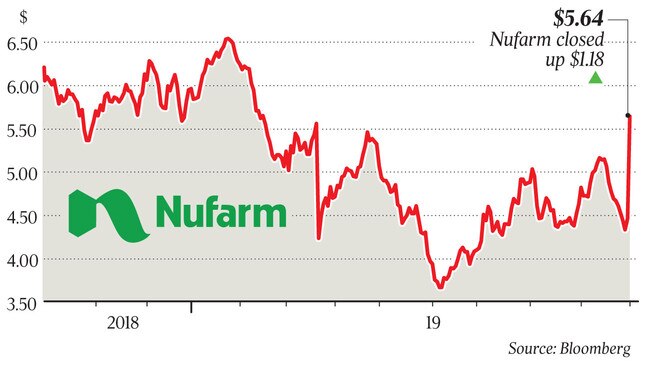

Nufarm’s share price soared on the announcements, rising as much as 55 per cent in early trade before settling back to close the day at $5.64, up $1.18 or 26.5 per cent.

Nufarm’s potential sale of assets was first flagged by The Australian’s DataRoom column on August 22.

Under the terms of the deal Sumitomo, a long-term business partner and Nufarm’s biggest shareholder with more than 25 per cent of its stock, will buy Nufarm’s crop protection and seed treatment operations in Brazil, Argentina, Colombia and Chile.

Sumitomo’s shareholding in Nufarm means the company will need to prepare an independent expert’s report on the transaction, and put the sale to a vote of shareholders at its annual meeting later this year.

But Nufarm chief executive Greg Hunt told investors on Monday the transaction was unanimously backed by the company’s board and represented “compelling value”.

“This transaction represents compelling value for Nufarm shareholders and will provide an opportunity to refocus on other parts of the business where we can generate higher margins and stronger cash flow,” he said.

The transaction represents 10 times the division’s underlying earnings before interest, tax, depreciation and amortisation.

Nufarm has also entered into a two-year supply agreement for the South American business with Sumitomo, if the sale closes.

Nufarm will buy back $97.5m of preference securities issued to Sumitomo in an August placement at the completion of the transaction.

Announcing its annual result on Monday, Nufarm said its underlying net profit after tax fell 9.5 per cent to $89.08m on revenue of $3.76bn, up 13.6 per cent.

It declared underlying earnings before interest, tax, depreciation and amortisation of $420.3m for the financial year, and net operating cash flow of $98.1m.

Nufarm will not pay a dividend for the year after suspending shareholder returns to “focus on reducing debt levels”.

Mr Hunt said it had been a difficult year for the global agricultural industry but Nufarm had delivered a steady performance.

The company was well placed to deliver further earnings growth and cash generation as conditions improved, he said.

“A full year contribution from the acquired European portfolios and strong performances in North America, Seed Technologies and Asia have driven earnings growth for 2019,” Mr Hunt said.

“While earnings are up, external headwinds constrained performance. The work we have done in 2019 sets a strong base to continue to improve earnings and cash generation in 2020.

“We’ve largely addressed the significant inventory overhang from drought conditions in Australia and made good progress in re-setting the cost base to make this a more resilient business while maintaining upside exposure to improved weather conditions.”

Analysts welcomed the sale yesterday, with Ord Minnett analysts saying the South American agricultural sector was “generally lower margin and higher cost and volatility”.

Moody’s Investors Services analyst Maadhi Barber said the said the opportunity to pay down debt outweighed the division’s contribution to Nufarm’s earnings.

“Nufarm’s announcement that it plans to divest its South American crop protection and seed treatment operations is credit positive, as it plans to use the proceeds of the sale to lower its leverage,” he said.

“On balance, we see this upside as outweighing the reduction in business diversification and scale from the sale, given that the Latin American segment contributed 23 per cent of the 2019 financial year’s earnings before interest, tax, depreciation and amortisation.”