Hoyts has successfully refinanced $550m worth of loans with Japanese bank Nomura coming to the aid of the cinema business.

Hoyts, as is the case with its rivals, has its cinemas shut in Sydney and Melbourne due to lockdowns, and this was after also losing business last year on the back of lockdowns amid the global pandemic.

It is understood that the group fully refinanced in recent weeks, with its debt lasting over a five-year term from Nomura.

Advisory firm Gresham has been working on the refinancing since the start of this year.

The refinancing comes after Hoyts held talks with prospective buyers earlier in the year, with Credit Suisse on the job to find a new owner.

The former owner of Hoyts, Pacific Equity Partners, was understood to have been approached, but was not a keen buyer at the asking price.

Hoyts is owned by China’s Dalian Wanda, which was thought to be a seller only at a price of at least $1bn at the start of the year.

Hoyts’ listed parent company, Wanda Film Holdings, is listed on the Shenzhen Stock Exchange and valued at just over $7bn.

Before the global pandemic, Hoyts was said to be generating as much as $150m of annual earnings before interest, tax, depreciation and amortisation.

Last year, the pandemic wiped out about 70 per cent of its earnings, and one of the hardest-hit parts of the business was its Val Morgan cinema advertising offering. Hoyts hopes to triple its EBITDA on a recovery.

Dalian Wanda Group, controlled by billionaire Wang Jianlin, purchased Hoyts from Pacific Equity Partners in 2015 for what was thought to be a deal worth $US750m.

PEP had bought the cinema chain in 2007 for a price that valued the business at $440m.

Hoyts operates at least 430 screens across Australia and New Zealand and rental machines in 650 locations, along with the Val Morgan cinema screen advertising operation, which is the leading national supplier across Australasia.

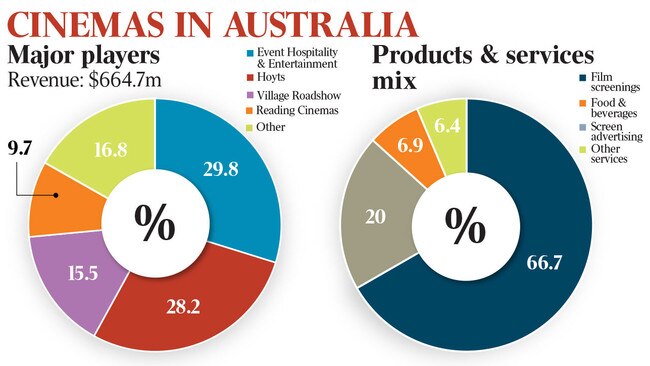

Meanwhile, analysts at Citi believe Hoyts’ listed rival, Event Hospitality and Entertainment, is materially undervalued, with its market value at $2.32bn.

The analysts believe the property portfolio of the Event Cinema, Thredbo Alpine Resort and Rydges hotels owner is worth $2.1bn.

However, the company is unlikely to be a takeover target with founding shareholder Alan Rydge holding a stake worth at least 20 per cent. One possibility is that Mr Rydge privatises the business, although some market experts are doubtful this would occur.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout