No gratitude for Latitude as $4bn IPO flops

A call from Latitude Financial Services chairman Mike Tilley mid-morning yesterday would have ruined the day of the team of investment bankers who had worked for the best of part of year to prepare the company to float.

The decision to shelve the IPO, which could have been worth up to $4 billion, was only made in the past few days, despite weeks of speculation the deal would be put on hold.

For UBS, Goldman Sachs and Deutsche Bank the decision means there will be no payday for working on one of the biggest floats of the year. Macquarie Capital was bought in late on the deal, along with retail brokers to try to get a deal done. The banks will remain mandated by Latitude but sources say another tilt at a float could be at least a year away.

There are now questions over exactly why it took Latitude and its advisers so long to realise that the royal commission would dent the appetite of investors for a financial services stock in the current climate.

The army of bankers reportedly believed a deal could be done but the wave of negative sentiment proved too strong in the end.

Meanwhile, the ongoing uncertainty in world markets 10 years on from the global financial crisis has prompted a sharp fall in the number of companies looking to list this year.

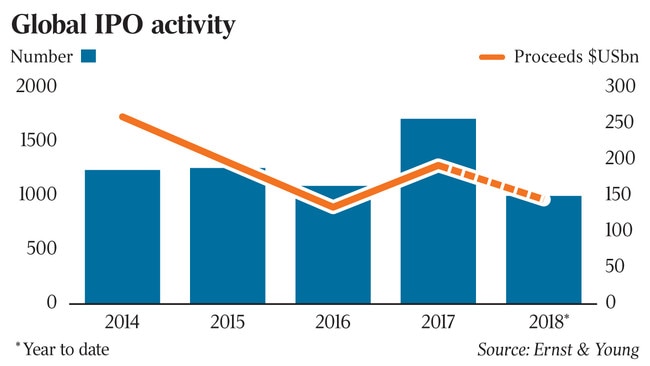

A major survey from EY has found that 1000 companies have turned to the public markets in the first nine months of 2018, down 18 per cent on the same time last year.

In Australia, the global trend is playing out and it’s a situation that equity capital market bankers are hoping will change in the final few months of the year.

A report from Deloitte found that in the first half of this year 40 companies listed on the ASX and raised $1.8bn, down from 57 at the same time last year.

On the global front, the listings so far in 2018 have been worth $US145.1bn, which was up 9 per cent as the result of some major deals unfolding in Asian markets.

In the third quarter, there was 302 IPOs worth $US47.1bn, which was down 22 per cent on the number of individual deals. However, the value of the transactions was up 9 per cent compared to last year.

The EY report found that the technology, industrials and healthcare sectors were the most prevalent listings in the first three quarters, with deals worth about $US63bn.

The volume of deals in the Asia-Pacific region has soared in the past three quarter, due to a rush of large Hong Kong deals.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout