The contest for takeover target Bingo Industries could extend beyond the CPE Capital and Macquarie Infrastructure and Real Assets consortium, with murmurings in the market that at least one other party is waiting in the wings.

The name that comes up in conversation is Singapore’s Keppel Corporation, which is thought to be close to advisory firm Rothschild.

Keppel is understood to be circling Bingo, and while it is not believed to be currently in the data room, the understanding is that the Singaporean investor may be staying close to the action in the event of a retreat by the consortium bidding for the business - CPE Capital and Macquarie Infrastructure and Real Assets.

Bingo is currently in play, after the waste management company told the market last month that it had received a $3.50 per share offer from CPE Capital and Macquarie Infrastructure and Real Assets, valuing the company at about $2.3bn.

CPE and MIRA are currently carrying out due diligence, and the understanding widely held around the market is that the pair will emerge shortly with a slightly higher formal offer – somewhere between $3.50 per share and $4 per share, including franking credits.

Expectations are that Bingo’s major shareholder Ian Malouf and CEO Daniel Tartak will retain some ownership, with shareholders also offered the opportunity to take scrip in the company.

CPE and MIRA are considered the front runners to buy the business and groups such as Keppel may only come into the frame if the favourites walk away from the target.

The bid is a 28 per cent premium to the closing price before news of the offer was made known in the market.

Market analysts say that an acquisition of Bingo would make sense for Keppel, which is no stranger to the Australian market.

Keppel bid for the $1.5bn-plus credit-checking company Illion that was up for sale by Archer Capital in 2019.

It also purchased the Ixom chemicals business that was previously part of Orica from Blackstone in 2018 for $1.1bn.

Bingo, advised by UBS, is heavily weighted towards the construction industry, making money from waste recycling and waste disposal contracts on construction and infrastructure jobs, with its large skip bids used for building projects.

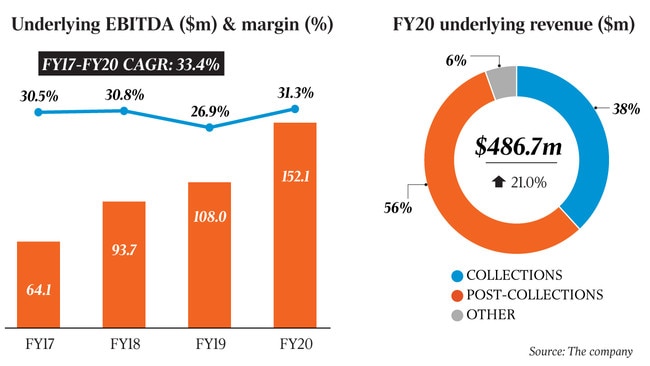

The company was listed by the family of chief executive Daniel Tartak in 2017 with its value at about $628m. He currently holds a 19.8 per cent stake.

After Bingo bought Dial a Dump in 2019 for $577m, Dial a Dump owner Ian Malouf became a shareholder. He currently owns about 12 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout