Meetings fuel forecast of Transurban’s WestConnex win

Investment bank Morgan Stanley has started scheduling meetings with infrastructure investors that hold shares in its client Transurban, fuelling suggestions that the toll-road operator may have won regulatory clearance to buy a $5 billion-plus stake in WestConnex.

Infrastructure investors that have shares in Transurban have said that Morgan Stanley’s equity capital markets bankers have asked for meetings this morning, but have not specified what the meetings relate to and what company they involved.

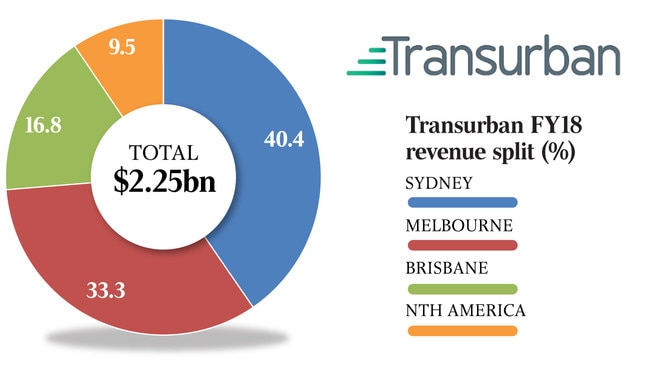

The Australian Competition & Consumer and Consumer Commission is due to come out this morning with its findings on Transurban’s bid for a 51 per cent stake in Sydney Motorway Corporation, which owns the three-stage WestConnex Sydney toll-road project.

It is expected that the NSW state government will either announce the winner of the WestConnex competition at the same time as the ACCC finding is out or a day later.

Final bids for the toll-road business were due last month, with two consortiums — one headed by Transurban and another by IFM — the last left in the final stages of the contest.

Transurban is working with UBS and Morgan Stanley on its bid for WestConnex.

Because the state is waiting for the ACCC outcome on Transurban’s bid — one that is conditional on regulatory approval — it has prompted the market to speculate that the toll-road operator has offered a far higher price than the IFM consortium.

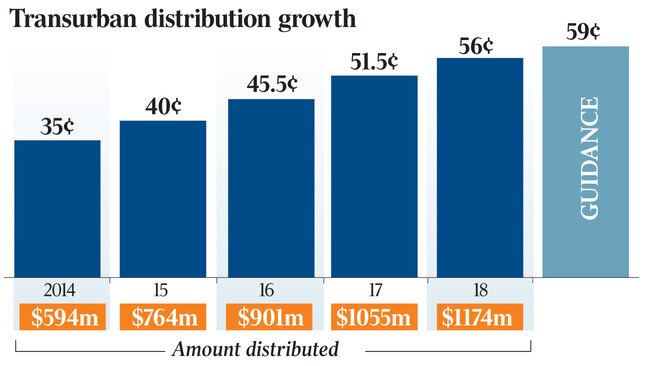

DataRoom reported on August 3 that Transurban was expected to raise between $2bn and $3bn. Many now believe the amount will be closer to $3bn or possibly more, with the anticipation that Transurban will offer a staggering price for the 33km predominantly underground motorway.

Macquarie Capital is also believed to be working with the group in the event of an equity raising.

UniSuper is a major Transurban shareholder and is expected to take a sizeable amount of stock.

Sydney Motorway Corporation is understood to have an enterprise value of $20bn, with about $10bn worth of debt. It means that the buyers of the stake on offer would probably pay at least $5bn in equity for the 51 per cent interest.

However, much of what cash is paid upfront depends on the amount of construction debt that is allocated to stage three of the project, which is yet to be completed.

Transurban’s partners include AustralianSuper, the Abu Dhabi Investment Authority and the Canada Pension Plan Investment Board, while IFM is working with OMERs and Dutch fund APG and has Citi and Bank of America Merrill Lynch as its advisers.

Goldman Sachs is working for the state government.

What is keenly awaited to see in terms of the ACCC is whether Transurban is offered full approval to buy WestConnex or approval based on conditions.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout