Macquarie, KKR, China Life aborted AMP bid plan

Private equity giant Kohlberg Kravis Roberts, China Life and Macquarie Group made plans for a three-way takeover bid for AMP earlier this year but opted not to proceed with an acquisition of the $14.5 billion listed financial company, according to sources.

DataRoom can reveal that the trio ran the ruler over the Australian wealth manager and insurer that has failed to fire in recent years and remains under pressure from its investors who are eager to see an improvement in its performance.

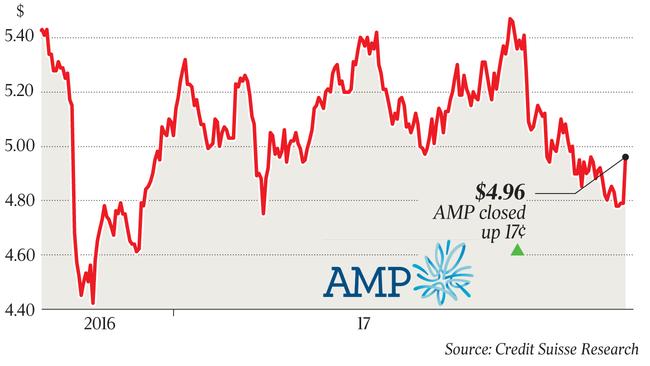

The company’s shares were worth close to $22 in 2001 but closed yesterday at $4.96.

As part of the plan, China Life would buy the life insurance arm, which is currently being reviewed for a potential sale, while Macquarie and KKR would buy the remainder.

However, a deal never eventuated and the consortium walked away.

Ironically, Macquarie is now AMP’s defence adviser.

AMP declined to comment yesterday, but sources close to the company described the speculation as “far-fetched”.

However, it is not the first time Macquarie and KKR have partnered on a potential takeover bid, offering $7.3bn for listed lotteries business Tatts late last year with other backers. But that offer was rejected by the Tatts board and the consortium walked away.

Analysts say a takeover of AMP would be a difficult undertaking for any suitor and is likely to require the cutthroat approach that only a private equity firm could apply.

It is worth remembering that any buyer would also be regulated by the Australian Prudential Regulation Authority.

Meanwhile, the company continues to quash suggestions that chief executive Craig Meller is set to be replaced.

The talk around the market is that should Mr Meller in fact step down, Annabel Spring, the departing group executive of Commonwealth Bank’s wealth management division, would be a well-positioned candidate for the job.

Internally, AMP executive Paul Sainsbury is said to be well placed to succeed Mr Meller.

However, the widely held view is that an external hire would remain the best choice to revive the AMP business.

Yesterday, shares in AMP rallied 3.5 per cent following the release of an analyst note by Credit Suisse, which said AMP’s share price had underperformed the market by 10 per cent since its first-half earnings result.

The analysts said that AMP had further upside with its strategy to invest for future growth and with its shares being impacted by an expectation of cost savings and large capital return.

Credit Suisse has upgraded the stock to an outperform rating.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout