Macquarie crunching the numbers for AMP takeover

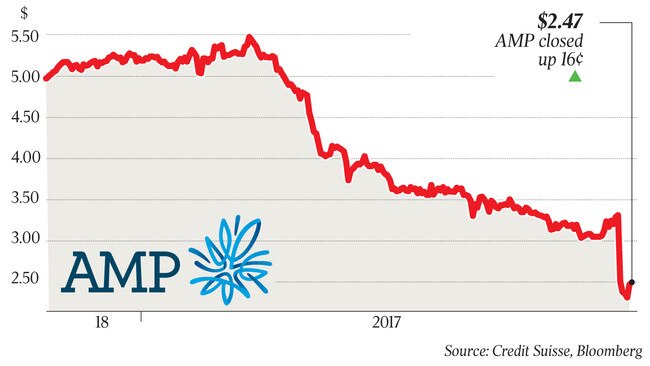

Macquarie Group has a potential $7.3 billion iron in the local merger and acquisition fire, and is said to be crunching the numbers on a tilt at beleaguered AMP.

Sources have told DataRoom that Macquarie had in recent months dropped away from the sell-side role — alongside UBS — for AMP’s multi-tiered life insurance sale and was weighing up an offer for the wealth group.

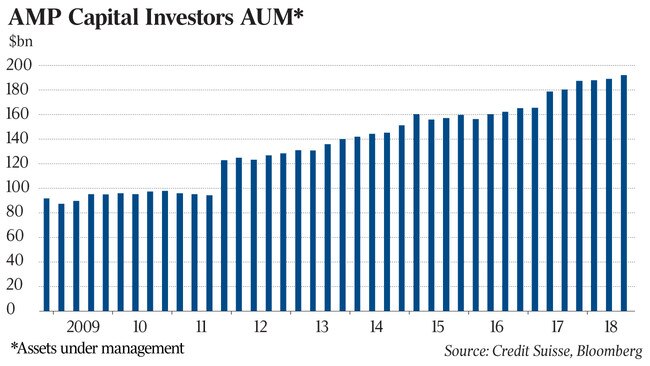

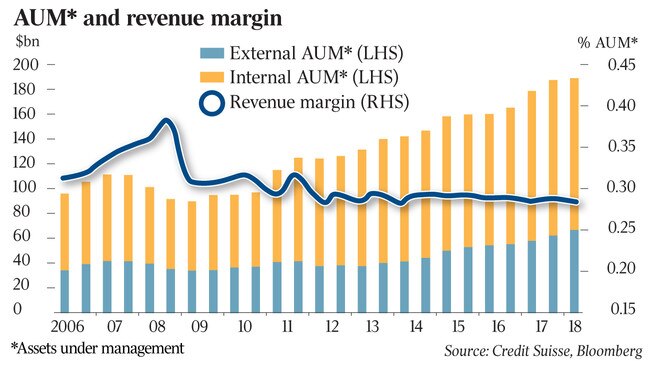

Incoming Macquarie chief Shemara Wikramanayake is said to have heavy involvement in assessing the investment logic as AMP shares hover near record lows, and the firm figures out whether to target infrastructure arm AMP Capital or make a whole-of-company bid.

If Macquarie were to proceed, which is yet to be decided, sources said the asset manager and investment bank would probably try to get a foothold on the AMP register first.

It is worth remembering that Macquarie considered an acquisition of AMP more than a year ago, aided by Kohlberg Kravis Roberts and China Life.

But with the controversial AMP life insurance sale in train, the transaction becomes a lot cleaner for Macquarie and makes it a smaller bite.

And while the infrastructure assets in AMP Capital are top of mind, the wealth group’s banking unit would deliver Macquarie much needed scale in the mortgage market.

AMP’s adviser network could also help Macquarie distribute its own infrastructure products.

At last count Macquarie had $3.4 billion in surplus capital, suggesting any on-balance-sheet acquisition would require a capital raising. Macquarie is, however, known for leading group bids that often involve its own infrastructure funds, which can then house the target assets.

Interestingly, the asset manager and investment bank is yet to kick off an already flagged share buyback, even though retiring boss Nicholas Moore told investors in July it remained in place. That’s a sign it stands ready to deploy capital, rather than returning it.

AMP was in the spotlight yesterday due to an investor backlash over the sale of its life insurance and mature products business to Resolution Life.

It has also became a topic of discussion as the Commonwealth Bank, advised by JPMorgan and UBS, announced the sale of Colonial First State Global Asset Management to Japan’s Mitsubishi UFJ Trust, which was advised by Morgan Stanley.

The Japanese financial powerhouse owns a 15 per cent stake in its asset manager AMP Capital and has stressed its intention to continue its strategic alliance with AMP after some questioned whether the stake could be for sale. One theory was that AMP Capital could end up in the hands of Mitsubishi UFJ (should Macquarie not acquire AMP first).

The remaining wealth, advice and mortgage broking business of CBA’s wealth management arm is set to be separately listed in a demerger next year and the other part of the equation involves the existing AMP business being folded into the CBA demerged entity.

But this is only one of the ideas in the market, and of course AMP has always stated that AMP Capital remains a core part of its operations.

Additional reporting: Joyce Moullakis

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout