Speculation is mounting that Queensland-based SunPork could be the next company in the smallgoods space to come to market, with Macquarie Capital said to be offering advice.

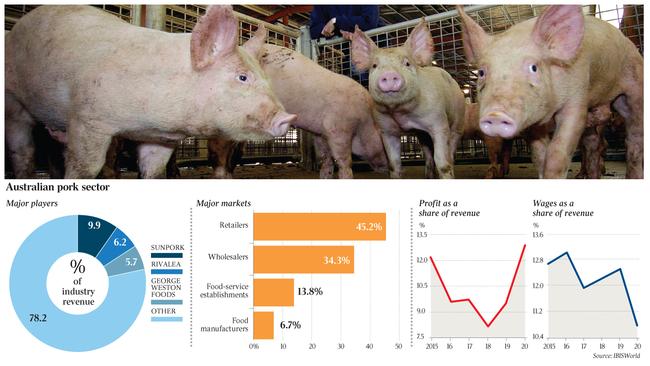

The company is Australia’s largest pork producer with 9.9 per cent of the market, according to IBISWorld.

It has 37 Australian farms in three states and six New Zealand farms, along with three feedmills, two abattoirs and other facilities.

The company provides 18 per cent of Australia’s pork, producing 900,000 pigs annually. It has more than 1400 staff and claims to supply 42 million kilos of pork annually to 1700 supermarkets internationally.

SunPork is owned by the Cameron, Hall and McLean families.

It is understood to generate earnings before interest, tax, depreciation and amortisation of between $25m and $30m.

It has invested $170m in its facilities since 2016.

Market analysts say such businesses trade at up to seven times normalised EBITDA, with industry earnings volatile due to input costs linked to grain and pig production.

The food industry appears to be awash with deals in the protein production space at a time that the coronavirus pandemic has made defensive businesses more appealing as investments.

Singapore’s QAF has shortlisted bidders for the sales process for its pork producer Riverlea, with JBS said to be in the mix to buy the asset, while another pork producer, Australian Food Group, is also for sale.

Adamantem Capital is believed to be considering a sale of its New Zealand smallgoods company Hellers through adviser Credit Suisse, but some suggest it could make an acquisition to roll up with Hellers ahead of an IPO.

The country’s third-largest poultry producer, Hazeldene Chickens, has also been put on the market through PwC.

After suffering from a glut of supply in the market, pork prices have staged a recovery in Australia, helped along by growing imports in China, which has been dealing with an African Swine Fever outbreak among its pig herd.