Flower company Lynch Group is expected to be worth between $572m and $729m including debt, according to analysts from Jarden.

Analysts are releasing research on the business as the private equity owners of Lynch Group ramps up plans for its initial public offering through Jarden Australia, Citi and Stanton Road Partners.

A roadshow for the float is happening this month ahead of a listing in April.

Jarden’s valuation estimates equate to between 10.9 and 13.9 times a forecasted earnings before interest, tax, depreciation and amortisation on an enterprise value basis for the 2021 financial year.

The analysts say that the peers of Lynch in the agricultural space trade at about 11.5 times while listed fruit and vegetable Costa Group trades at about 10.6 times.

Owned by Next Capital, Lynch Group describes itself as a vertically integrated floral wholesaler with operations in Australia and China.

The business expects to generate annual revenue of about $316m and net profit after tax and amortisation of $28.7m for the 2021 financial year, up 140 per cent from the previous corresponding period.

This follows the impact from the global pandemic and after China increased costs from the previous corresponding period.

Lynch, which grows most of its flowers in China, is the country’s largest floral wholesaler in Australia, providing 88 per cent of the supplies to supermarkets.

It is also China’s number one premium flower grower in what is a fragmented market.

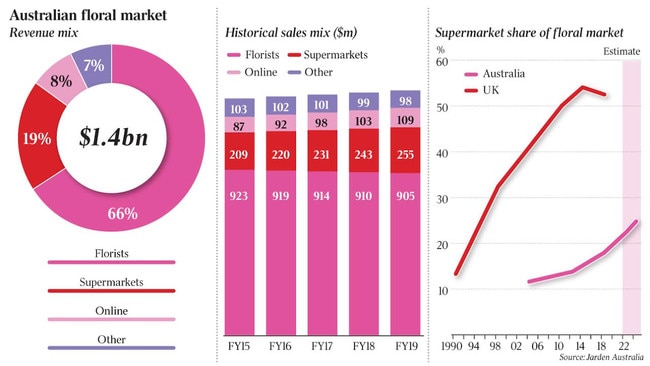

Drivers for earnings growth are expected to include supermarkets growing their market share of the floral retail market, currently with about 19 per cent.

Florists hold about 66 per cent.

Lynch is looking to list as another private equity firm, Allegro Funds Management, also makes preparations to float apparel and homewares company Best & Less Group.

Working on the transaction along with Macquarie Group is Bell Potter as part of an attempt to court retail investors.

Joining the board are Temple & Webster chairman Stephen Heath and Melinda Snowden.

Best & Less, which has 245 stores, generated $629m in annual revenue last year and has recently seen sales growth of 9.2 per cent in the ‘Back to School’ category between November and January.