Bidders for Qube’s $2bn Moorebank logistics park are expected to learn the outcome of the sales process within days.

Charter Hall, Blackstone, Dexus Property Group, Logos Group, ESR, which is backed by Warburg Pincus, and Kohlberg Kravis Roberts were all earlier in the mix, but KKR withdrew.

Previously, some suspected that Logos would leave the competition, with the group beaten by other heavyweights that could secure more funding, but now the suggestions are that it may have put forward a strong price for the prized Sydney industrial park and win the competition.

Others said it was too soon to determine an outcome.

Logos is an Australian-based logistics property specialist with operations across the Asia Pacific, with ARA Asset Management as a major shareholder.

ARA has $88bn in gross assets under management globally.

Other investors are Canadian real estate investor Ivanhoe Cambridge, which has $C64bn ($67bn) of real estate assets globally, and Logos founders, including joint managing director John Marsh.

In Australia, Logos has 1.2 million square metres of logistics real estate across 13 properties and it manages other industrial portfolios globally, including the ARA Logos Logistics Trust, a Singapore-listed real estate investment trust with 27 properties across Singapore and Australia.

Working on the sales process since late last year is the outgoing head of real estate at UBS, Tim Church, who will soon move to Morgan Stanley, where he will be chairman in Australia after handing in his resignation to the Swiss bank in recent weeks.

It is understood that final bids were received a number of days ago and a meeting was held about the process on Friday.

Most expect Qube to sell between 50 and 75 per cent of the logistics park’s land trust and warehouse trust, worth $2bn, with Qube to retain the terminals trust.

However, it is thought that at least one bidder may have put forward an approach to buy all of the asset.

The deal could shape up as the largest mergers and acquisition transaction during 2020 in the real estate space.

While the global health crisis has weighed on landlords, the industrial property sector is seen as one of the most resilient, with online shopping in strong demand and offering some relief to the economic fallout.

The yet-to-be-completed Moorebank intermodal facility, in southwest Sydney, is the largest in the country, with the park covering 243ha.

It is being developed on a precinct comprising land owned by the commonwealth and adjacent to land owned by Qube.

Woolworths is a key tenant.

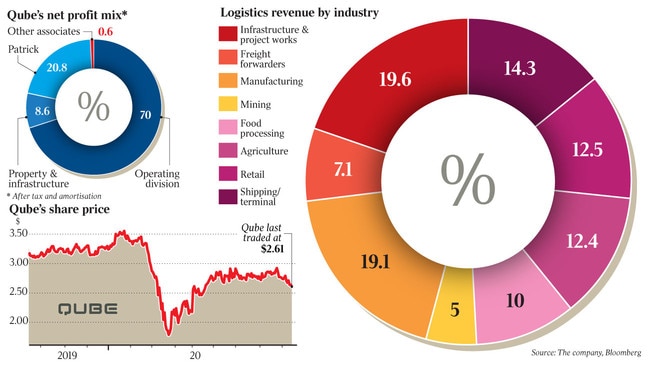

Qube is selling the logistics park at a time that it is investing capital into its business.

In April, it raised $500m in equity to lower its debt levels, which are now at about 26 per cent of its earnings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout