A sale of Lendlease’s engineering business to Spanish conglomerate Acciona is said to be imminent, with the group poised to buy the business in a highly conditional deal.

While it is understood that a sale of the engineering arm is just days away, the services business will be divested at a later stage, with the Chinese-owned John Holland said to be closing in.

Earlier, Italy’s Salini Impregilo was in talks to buy the engineering arm but has since withdrawn from the competition.

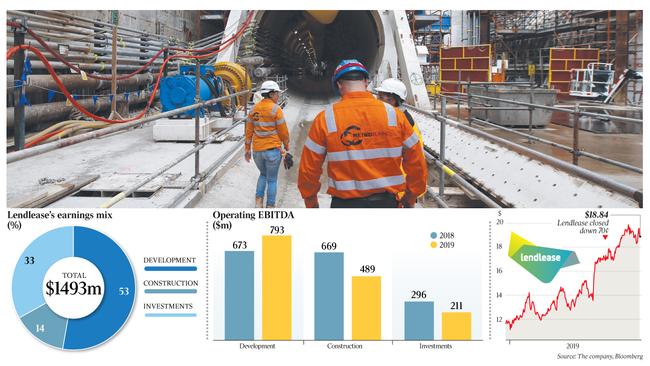

Lendlease has been selling its engineering and services operations through investment bank Morgan Stanley and boutique adviser Gresham at a time when it continues to wrestle with cost blowouts predicted to be in the order of $2bn on the Melbourne Metro Tunnel Project.

Lendlease has a 33 per cent interest in the consortium building the tunnel, along with John Holland and Bouygues Construction.

Acciona has had plenty of experience dealing with costly government projects after carrying out the Sydney light rail project for the NSW government that was plagued by cost blowouts and disputes with the state.

A mediator has been called in to manage what has been described as a pending stoush between the state government and the consortium building the $11bn project.

Lendlease chief executive Steve McCann reiterated at the company’s annual general meeting that a $500m provision for its engineering business had been for three projects, two of which, including the NorthConnex in Sydney and Kingsford Smith Drive project in Brisbane, were due to be finished next year.

The other project is the Gateway Upgrade North in Brisbane.

The engineering business closed the year with a backlog of $3.8bn and the company said it remained active in bidding for work that was in line with the revised lower risk appetite that came out of a recent strategic review.

The services division had a $1.6bn work backlog and an attractive pipeline of future opportunities.