Investment bankers at UBS were believed to be driving a decision to reprice Latitude Financial Group’s initial public offering lower on Monday as the private equity owners face a nervous wait to see if the deal will get across the line.

The company will now list with a $3.17bn market value and raise $1bn.

It comes with the company’s shares being repriced at $1.78 per share on Monday after the pricing was fixed at the bottom of its range at $2 per share last Friday.

It is understood that investment bank UBS called clients over the weekend to test their appetite.

The understanding is that investment banks leading the deal, which also include Macquarie Capital and Goldman Sachs, were eager to see the company trade well in the aftermarket, which was behind the decision, as the global IPO environment remains fickle.

Working for Latitude’s shareholders, including Varde Partners, Kohlberg Kravis Roberts and Deutsche Bank, is boutique advisory firm Insight Capital Partners.

The price now equates to 11 times forecast net cash profit, equating to a 5.8 per cent yield.

On Friday, Latitude locked in a raising size at the bottom of its range, at $1.245bn. The dividend yield was to be 5.2 per cent.

Other deals this year have been riding on the success of Latitude, which provides personal and in-store credit card loans as well as a buy-now-pay later service.

The company’s bookbuild will be held on Tuesday ahead of a listing on Friday.

The Latitude pricing comes after plans for the IPO of MPC Kinetic were shelved last Thursday after it was downsized on the back of weak demand.

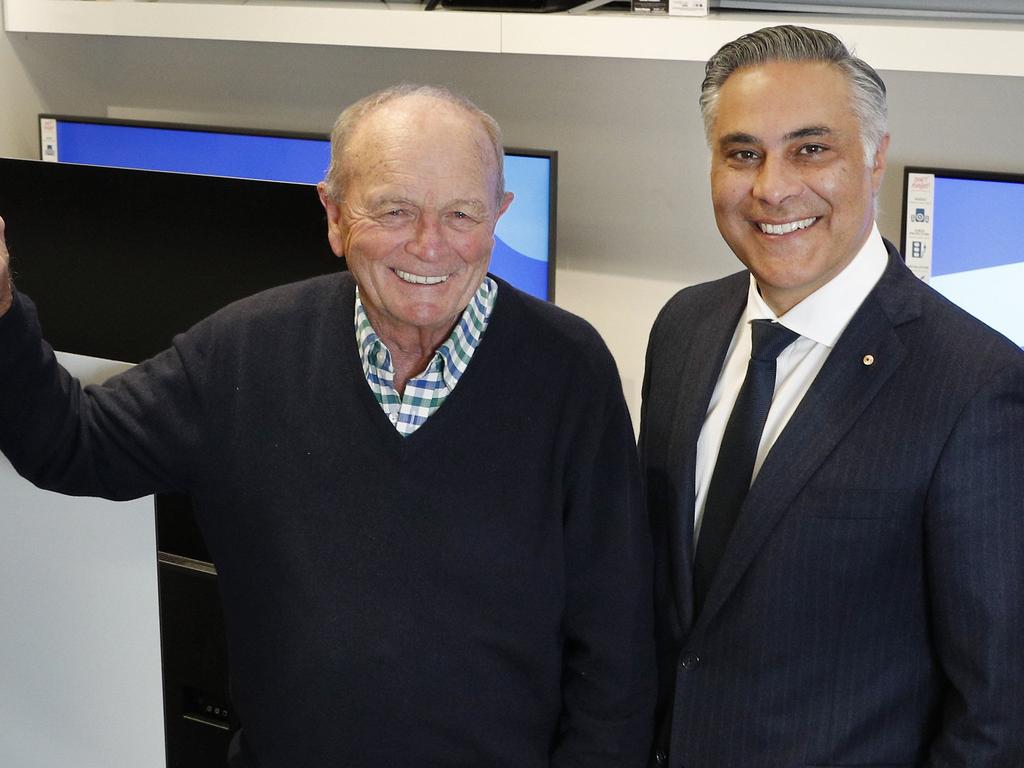

Latitude, which is run by Ahmed Fahour, last week allocated 25 per cent of its shares to retail investors in an allocation worth $330m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout