As David Jones continues to negotiate with landlords and explore asset sales with KordaMentha and UBS in its corner, it is now understood that its rival Myer has built up an army of its own in its fight to survive COVID-19 conditions, hiring KPMG.

It is now known that KPMG is advising the group as COVID-19 troubles compound difficulties already confronted by all global department stores brought about by the growing competition from global online retailers.

KPMG is carrying out the work for Myer as it acts as the administrator for failed real estate chain LJHooker and is assessing liquidity options for Air New Zealand.

Sources close to the department store maintain that KPMG has offered its services to Myer for a couple of years and is currently assisting with its supply chain, as well as examining working capital and refinancing solutions.

It comes as Myer, which counts Solomon Lew’s Premier Investments as a major investor, has been in negotiations with landlords, after closing for business during the coronavirus related disruptions around March and April.

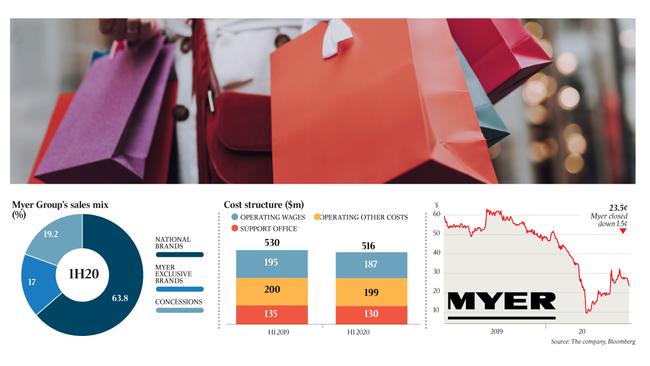

Myer’s share price has staged somewhat of an improvement, with its market value now at about $200m after hitting $95m in March, which was a quarter of what it was worth at the start of the year.

Myer was $103m cash positive at January with net finance costs of $49.8m, yet there have been some concerns about it coming close to breaching its debt covenants with limited earnings coming through its doors.

Yet, many have been impressed with chief executive John King who joined the retailer about two years ago and last year put Myer back into profit making territory.

At Myer’s rival, David Jones, UBS and KordaMentha have been offering assistance with the David Jones capital structure and a sale of its real estate, which comprises its flagship store in Melbourne’s Bourke St.

However, a dilemma for David Jones is that its main point of contact at UBS, Aidan Allen, who has been working on the Davis Jones file, is departing to New Zealand boutique Jarden, so it will be interesting who picks up the job from now on.

One possibility is that it will fall into the hands of Greg Peirce, who is returning to the Australian offices of the Swiss Bank from his current post in Hong Kong or the UBS investment bankers concentrating on the Australian retail sector.

No doubt, it will be the call of acting boss Ian Moir.

David Jones is owned by Woolworths South Africa, which also owns Australian fashion label owner The Country Road Group.

The department store won a waiver from its lenders on its debt covenants and was handed a $75m loan from its parent company.

Woolworths South Africa has a debt pile on its Australian businesses worth $464m.

Retailers remain under the spotlight as many try to position themselves for a strong recovery from the COVID-19 pandemic.

On Monday, Super Retail Group announced it would tap the market for $203m, which some suspect could create a war chest for acquisitions, given the owner of brands such as Macpac, BCF, Rebel Sport and Supercheap Auto has feared better than other retailers.

Shares were sold at $7.19, which was a 7.9 per cent discount to the last close, in a deal handled through Macquarie Capital and UBS.

Meanwhile, there is some chatter in the market that the 14 stores that fashion retailer City Chic announced had closed were all in Westfield shopping malls owned by the Australian landlord Scentre Group.

Scentre Group is said to be playing hard ball with its tenants impacted during COVID-19, taking the view that if they do not agree to its lease terms, they must vacate its shopping centres.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout