The past 18 months has been a blockbuster period for ASX floats, as the IPO window blasted open despite pandemic-inspired uncertainty.

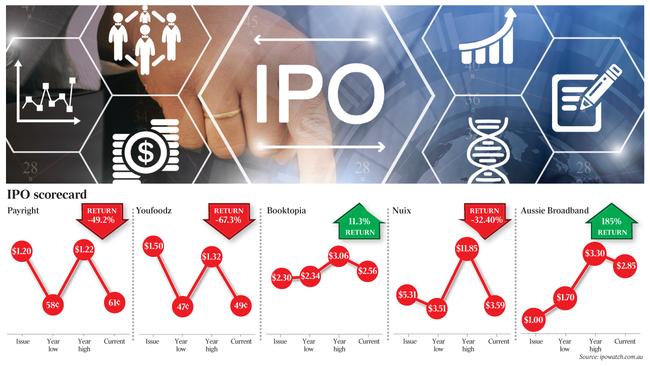

But despite a few standout performers such as Aussie Broadband, investors who decided to hold on to the most-hyped floats of the last year haven’t had the best results, suggesting that the old institutional adage about new listings — buy cheap, profit early — still has some currency.

When analytics company Nuix listed in December in a $1.8bn float, it was the biggest IPO of 2020, and one of the most eagerly anticipated.

After a strong start to listed life, with shares peaking at $11.85 in January, Nuix has been on a long slide and closed Friday at $3.59 — 32.4 per cent below its $5.31 float price and almost 70 per cent off its January peak.

The slide began with a disappointing set of financial results in February, and Nuix tanked badly when it cut guidance in April.

The institutional investors that bought a collective 177m shares in the Nuix float would have taken a collective $304.4m bath if they were all still hanging on to their shares.

The story is worse for investors in Adore Beauty’s $6.75 float last October, with the beauty retailer closing Friday at $3.68, down 45.5 per cent from its float price, despite the company beating prospectus forecasts and saying last week its third-quarter revenue was up 47 per cent on the same period last year, to $39.4m.

Adore raised $270m in the IPO, and listed with an indicative capitalisation of $635m. It is now worth about $348.3m.

October 2020 was an extraordinarily mixed month for ASX floats – and perhaps highlights that hot stocks in a pandemic don’t look so hot when the country enters recovery mode.

Furniture and garden e-commerce marketplace MyDeal raised $40m in a $1 float, listing with a market cap of $260. It is now worth 65c a share.

Face mask maker Cleanspace Holdings also got a $300m IPO away at $4.41, with existing holders offloading $112m to new holders and the company raising $20m in fresh cash. It’s now worth $1.81 share, down more than 58 per cent.

October’s listings also included the standout $190m float of Aussie broadband, which raised $40m at $1 and is now worth $2.85.

Ready-made meal company YouFoodz raised $70m at $1.50 a share, and was worth $202m after listing in December. It’s now worth $65.3m, at 48.7c a share.

BNPL entrant Payright raised $18.5m in its December IPO at $1.20 and is now trading at 61c.

The other high profile float of late 2020, Booktopia, which raised $43.1m at $2.30, is trading just ahead of par, at $2.56.

Airtasker is up 83 per cent from its 65c float price in March.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout