Onsite Rentals and Funlab expect to face an uphill battle when it comes to launching their initial public offerings in the coming days after four groups trying to collectively raise more than $1.6bn have abandoned their listing plans in the past two weeks.

Funlab, which owns Strike and Sky Zone entertainment centres, was believed to be weighing its options on Wednesday.

As with Onsite Rentals, it faces a tough task going cap in hand to investors who are increasingly sceptical about float hopefuls owned by private equity and distressed debt funds.

But Tyro Payments, which counts Atlassian billionaire Mike Cannon-Brookes among its backers, is still expected to find support for its IPO.

Funlab is owned by private equity firm Next Capital and equipment provider Onsite Rentals was recently recapitalised by distressed debt funds and both businesses have so far received an underwhelming response from investors.

READ MORE: Why the next financial crisis could be worse

Some believe that Onsite Rentals’ owners will ultimately end up in the hands of a trade buyer, although those close to the situation on Wednesday indicated it was business as usual with the book build to proceed on Monday.

Sources close to the company late Wednesday dismissed suggestions that the deal was in the process of being repriced.

It comes as both the owners of Retail Zoo and PropertyGuru announced on Wednesday they had abandoned their float plans.

Latitude Financial called off what was the largest IPO of the year last week and MPC Kinetic the prior week.

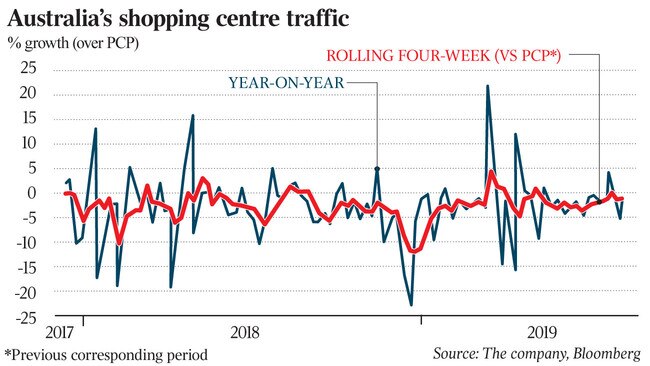

For days, fund managers have maintained that PropertyGuru was worth up to half of the value of up to $1.4bn it had placed on the company and that Retail Zoo, which owns Boost Juice, was unattractive at a time that franchise food operators broadly across the industry have been under fire for the mistreatment of franchisees, who have also been accused of underpaying employees.

Laying the blame

Institutional investors on Wednesday were quick to lay the blame at the companies themselves rather than the overall market conditions as a whole.

The biggest problem with the deals has been that there has been a lack of visibility with earnings, according to fund managers spoken to by this column.

Groups that were not currently profitable were “selling a dream” or a store rollout story.

They believed a larger discount needed to be provided to prospective investors for taking a risk on their unproven track records.

But for the right deals, fund managers say that the market will offer support.

Tyro Payments is so far proving popular with investors, and while some say in the worst case scenario it may be priced lower, they believe it will definitely find support to list by the end of the year at the earliest.

The group is believed to raising only up to $250m and is valued at more than $1bn.

Retail Zoo was understood to have been making efforts to cornerstone its IPO at a price equating to 15 times earnings, taking its market value to about $300m but it did not secure support from investors, some of who were prepared to buy in at between 12 and 14 times.

The company is owned by founder Janine Allis and husband Jeff, and Bain Capital.

Tough year ahead

It appears to be a tough year shaping up for equity capital markets investment bankers, with the only saving grace from few IPOs hitting the market being the fact that a number of major equity raising have been launched this year, predominantly in the real estate sector, with JPMorgan and UBS dominating with respect to the market share of those deals.

Working on the IPO of Retail Zoo had been Goldman Sachs, UBS and Citi, while UBS and Credit Suisse, Ord Minnett and Morgans were floating PropertyGuru.

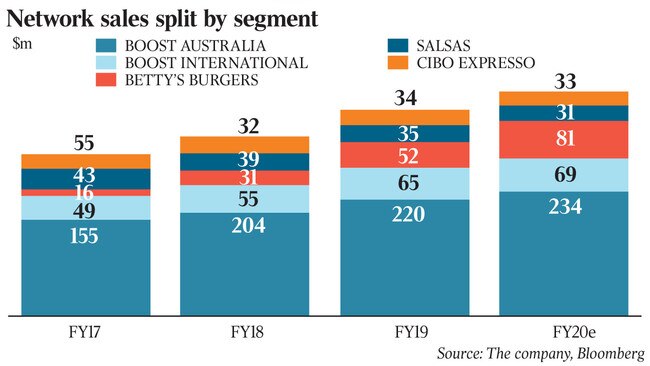

Retail Zoo had planned to use funds to mostly expand its Betty’s Burgers chain.

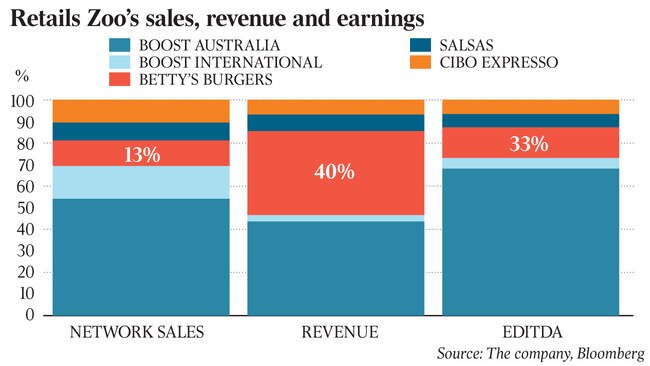

Overall, it has 596 franchised stores and 47 company-owned stores across Boost, Betty’s Burgers & Concrete Co, Cibi Espresso and Salsas and the plan is to increase its store count by 62 per cent in the medium term.

Boost is the largest player in the Australian juice and smoothie bar category with 59 per cent market share and its sales were forecast to grow 10.8 per cent per year on average to 2023.

Earnings before interest, tax, depreciation and amortisation for the 2020 financial year is expected to be $37.8m for the 2020 financial year, up from $31m during fiscal 2019.

PropertyGuru was selling shares at between $3.70 and $4.50 as it looked to raise between $345m and $380m.

The raise took its market value to between $1.2bn and $1.4bn, with the company to be priced on Thursday ahead of a listing on Friday.

The company’s price range equated to between nine times and 10.9 times PropertyGuru’s forecasted revenue, which The Australian’s columnist John Durie reported earlier this month was more than the Domain Group in Australia, which was profitable and traded at 6.4 times revenue.

PropertyGuru in recent days had found some support on the back of TPG Capital and KKR retaining their interest in the business.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout