Prospective investors being approached about the initial public offering of discount furniture chain Fantastic Furniture feel like they are experiencing a case of deja vu given they remember the hopes management had when the same business was listed only four years ago.

On Friday, the company released analyst research on the retailer for a prospective float by the owner Greenlit Brands, which is a subsidiary of Steinhoff International – the company that bought the listed business in 2016.

Analysts at Macquarie Capital valued the discount furniture chain at between $435m and $669m including debt, which equates to between 6.5 times and 10 times its earnings before interest and tax.

Credit Suisse analysts valued the business at between $762m and $959m, equating to between 10.2 and 12.9 forecast annual EBIT.

But as analysts described how the company had aspirations to grow from beyond 81 stores to close to 100 and expand into New Zealand, some have remarked that similar hopes were described the last time the company headed to the boards but never eventuated.

This time though, Steinhoff International is thought to be strapped for cash after a near-death experience about two years ago due to a share price collapse linked to accounting irregularities, and so favourable pricing may be a draw card.

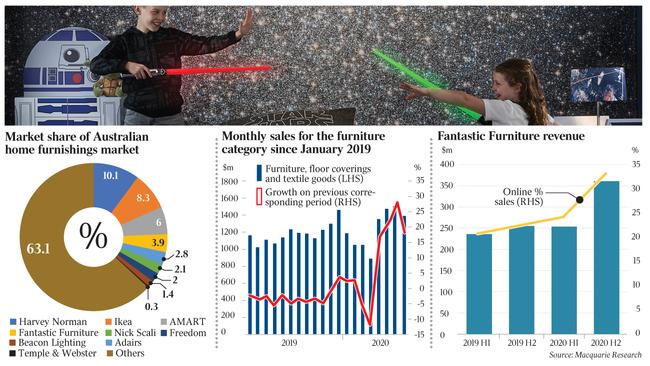

The company is clearly capitalising on a surge in spending online by consumers amid COVID-19, prompting its online sales to soar to about 29 per cent overall last financial year.

A question many are asking is whether it moves to buy competitor Amart Furniture once listed, which is also on the market by owner Quadrant Private Equity.

Some eyebrows were raised about Harvey Norman – arguably the number one furniture retailer in the Australian market and also listed – not being used by the analysts as a comparable.

Harvey Norman has been trading at 7.5 times its EBIT to enterprise value and analysts have suggested Fantastic Furniture is worth up to 12.9 times.

Instead, Fantastic Furniture was compared to companies such as Beacon Lighting, Adairs and up-market furniture chain Nick Scali.

Some promising news was that Fantastic Furniture’s market share in the value furniture segment has increased to 37 per cent from 34 per cent in the last four years and while its major competitor is Ikea in the affordable end of the market, the remainder is fragmented.

It has also had a new management team since 2018.

Fantastic Furniture has plans to list through Macquarie Capital and Credit Suisse as early as this year.

It is forecast to generate $650.7m of sales for the 2021 financial year, up from $550.7m in the 2020 financial year to June.

Earnings before interest, tax, depreciation and amortisation is expected to be $76.7m, up from $61.7m in the 2020 financial year to June.

Meanwhile, institutional investor sources around the market say that will apply close scrutiny to Dalrymple Bay Coal Terminal before buying into its IPO.

Market analysts say the company is generating $90m in annual funds from operations and has about $70m of capital spending, which is apparently being funded from debt, with its net profit at about $20m.

Gearing is about 10 times its EBITDA and some say that a regulated asset typically has debt levels of about 6 or 7 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout