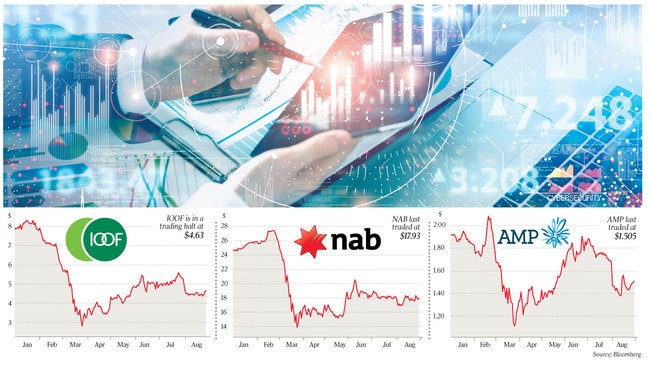

IOOF’s $1bn-plus deal to buy NAB’s MLC wealth management unit is expected to be announced on Monday following complex negotiations.

The stock remained in a trading halt at the weekend while plans were put in place for a $1bn equity raising through Citi to pay for the business.

Various options were on the table during negotiations.

It is understood some of the proceeds will be by way of a deferred payment.

The deal follows a sales process run by Morgan Stanley and Macquarie Capital that saw many private equity funds line up.

Most bowed out early on due to the capital that needed to be spent on the business, said to be up to $400m.

Kohlberg Kravis Roberts has had its eye on the operation for months but walked away due to concerns a deal would hold up regulatory approval for its other recent acquisition, a stake in CBA’s Colonial First State wealth management business.

JC Flowers, advised by JPMorgan, and CC Capital, advised by Nomura, were there in the later stages but always considered opportunistic acquirers with low-ball offers.

As flagged by DataRoom, talk emerged at the start of the month that IOOF — seen by most as an unlikely contender — was looking at the business, sparking much scepticism among analysts who thought it would be out of the company’s reach from a price perspective.

The understanding is that it will pay less than $1.5bn and raise equity at about $3.50 per share after the stock last traded at $4.63.

There were various moving parts to the negotiations, including discussions over whether limited cash would be paid and various earn-out components included.

Highly acquisitive in the past, IOOF is looking at lots of assets. It is considered a bottom feeder in wealth management.

Most have been betting that the deal will be funded by NAB.

While synergies with MLC do exist, they are not compelling, observers say. Experts also suspect IOOF will buy the wealth management business of AMP, which had UBS working on plans for a possible partial sale or demerger of its AMP Capital operation late last year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout