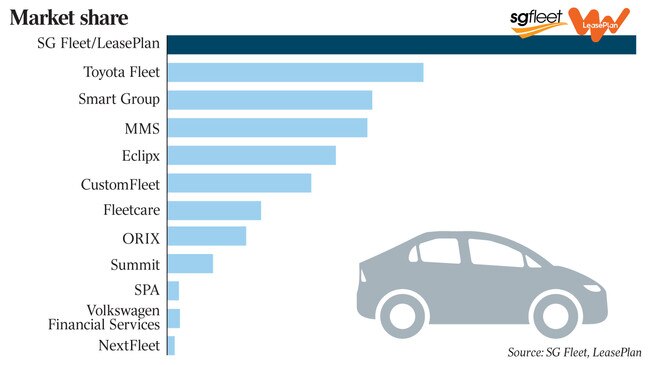

The overwhelming support from investors for SG Fleet’s $387.4m acquisition of industry rival LeasePlan has many in the market now hopeful of further consolidation – namely a tie-up between Eclipx and McMillan Shakespeare.

But those anticipating that Eclipx and McMillan Shakespeare will revive a merger that was in the making almost two years ago in the next few months are likely to be disappointed.

While it is largely expected that the pair will also get together, it is not expected to happen for at least a year with no current talks afoot.

McMillan Shakespeare is working on improving the performance of its operations in Britain, where the pandemic has taken its toll.

McMillan made a bid for Eclipx in 2018 when it was worth about $912m, but after the target had numerous profit downgrades McMillan Shakespeare opted to walk away from the target and pay out the break fee for the deal.

McMillan Shakespeare had at the time put forward an offer of 0.1414 McMillan Shakespeare shares and 46c cash for each Eclipx share held, but the value later dived as Eclipx updated the market with bad news.

Eclipx later sold off troublesome divisions.

SG Fleet also made an offer for Eclipx.

However, most believe that the latest acquisition of LeasePlan makes perfect sense for SG Fleet.

Industry conditions are booming for fleet leasing companies with second-hand car sales currently fetching strong prices due to the lack of imports making their way to Australia amid the global pandemic.

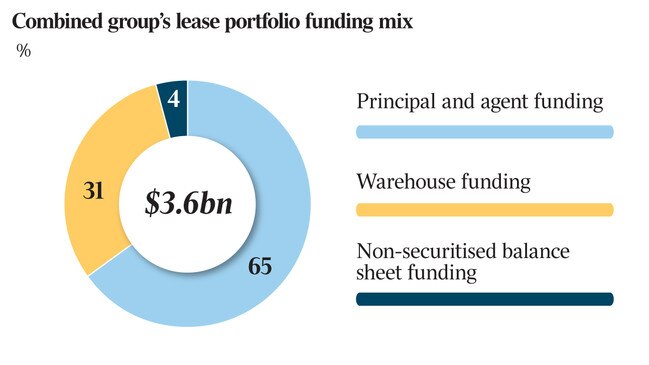

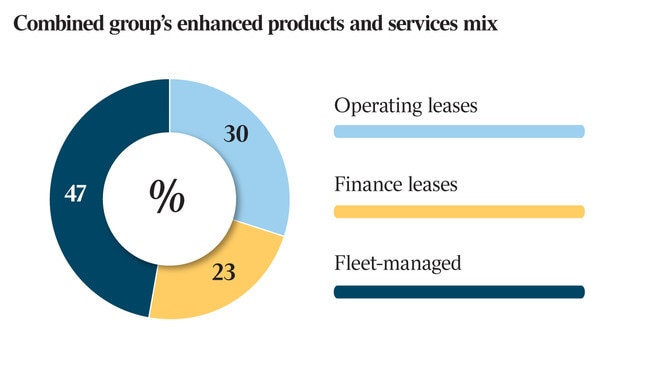

SG Fleet needed to get further into asset management, an area of strong expertise for LeasePlan, which has an asset pool of $1.4bn and also was in need of LeasePlan’s funding capability, which would have taken a long time for SG Fleet to develop on its own.

The deal takes the value of assets under the merged company to $3.8bn and its enterprise value to $2.5bn after SG Fleet was earlier worth $800m including debt.

There are also significant synergies worth $20m.

LeasePlan target finances, manages, procures and disposes of vehicles on behalf of its customers and while the global company is based in the Netherlands, it is only the Australia and New Zealand operations that are being purchased by SG Fleet.

SG Fleet’s $86.3m equity raising at $2.45 per share was a 5 per cent discount to its last closing price of $2.58 on March 23 when it entered a trading halt.

It has been massively oversubscribed by investors, demonstrating their support of the transaction.

The price at 14.3 times net profit is good news for Eclipx shareholders who want a suitor to pay top dollar for the business.

At this ratio, a buyer would be offering a 30 per cent premium to Eclipx’s current trading price, and it remains in line with the current price of Canadian competitor Elemental Fleet Management.

DataRoom revealed in December that SG Fleet and LeasePlan were working on a tie-up and as earlier reported by this column, the deal has been in the works for two years.

The transaction was earlier thought to be worth between $300m and $400m in a debt and scrip offer and the arrangement that both have come to is that SG Fleet will pay LeasePlan $273m cash and will offer a 13 per cent stake in SG Fleet. It is understood LeasePlan is working with Goldman Sachs and SG Fleet with Bank of America.

LeasePlan is owned by the LP Group consortium, which includes a group of pension funds such as Singapore’s GIC and the Abu Dhabi Investment Authority, while South Africa’s Super Group is a majority shareholder in SG Fleet.