Investor nervousness creeps in as Viva Energy deemed too expensive

The phones are ringing off the hook at various Australian equities investment houses and many of the calls are understood to be coming from those working on Viva Energy.

While the price range has not yet been set for the float of the Australian petrol station operator and oil refiner, fund managers are cautious that the initial public offering — judging by the analyst valuation estimates — is shaping up to be expensive and believe the company should be sold at a discount to Caltex.

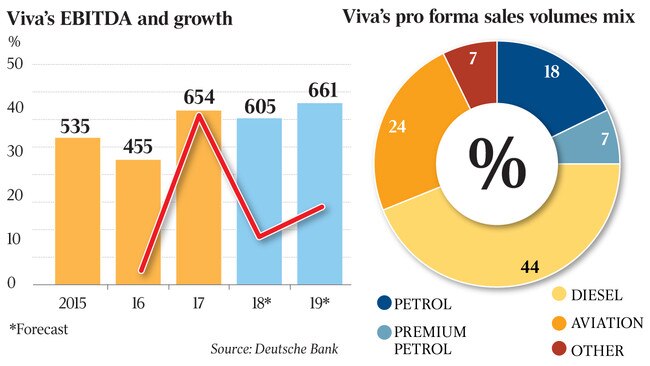

Analysts working at the investment banks on the deal have already valued the group at between 7 and 9.2 times its earnings before interest, tax, depreciation and amortisation.

Caltex trades at 7.5 times EBITDA and investors think Viva Energy should be worth less.

Listed oil refiner and retailer Caltex not only has an operating business but also owns the real estate of its service stations, whereas Viva sold its real estate via an IPO, of which it owns a 38 per cent interest.

Z Energy, in New Zealand, which is considered a similar business, also trades at about 7 times EBITDA.

Apparently, fund managers are getting a lot of calls about the deal, which is normally a sign that some nervousness exists that investment banks may not be able to drum up enough support for owner Vitol to list its Australian business.

The company itself is widely accepted to be solid, but the challenge for joint lead managers Deutsche Bank, Bank of America Merrill Lynch and UBS is the sheer size of the transaction.

It is expected to list as a company worth about $5bn and it needs to sell about $3bn worth of stock, which is a lot for the Australian market.

While the price range has not yet been set for the IPO, the owners may have to err on the conservative side to lock in enough demand.

Finding cornerstone investors is always thought to have been part of the plan, but even that is expected to be tough, with some of those approached asking whether they would need to participate as a cornerstone investor when plenty of stock is likely to be available.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout