Investec said to be assisting on $2.9bn attempted acquisition of Link Administration Holdings

The Carlyle Group and Pacific Equity Partners are understood to have brought in South African bank Investec to assist with its $2.9bn attempted acquisition of Link Administration Holdings.

The two private equity funds that have offered $5.40 per share for Link by way of a scheme of arrangement have already been working with Jarden.

Credit Suisse has been offering assistance.

However, it is understood that Investec will assist the private equity firms on Link’s interests in the Property Exchange Australia business, known as PEXA.

Investec aided Morgan Stanley Infrastructure Partners on its acquisition of PEXA in 2018 when it was part of a consortium that bought the business for $1.6bn, along with Link and the CBA.

Since the private equity firms lifted their offer to $5.40 per share from $5.20 per share, the company’s share price has drifted lower.

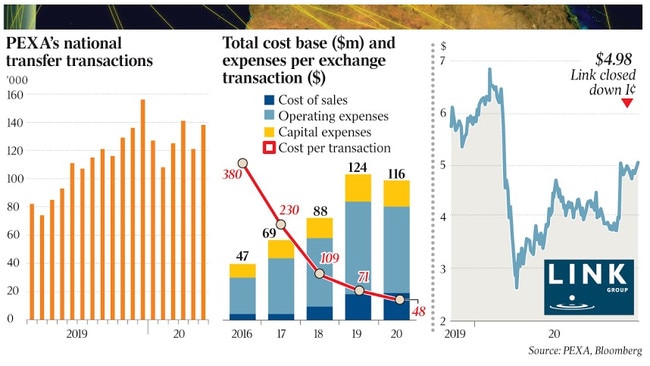

Shares closed 1c lower to $4.98 on Thursday.

Shareholders may be wary that Carlyle and PEP may walk away from the target after applying more scrutiny, which has occurred when buyout funds have embarked on due diligence for a potential takeover target in the past.

Carlyle and PEP are currently carrying out due diligence on Link after being granted access to due diligence materials from the board on a non-exclusive basis.

This was despite Link directors rejecting its latest offer.

The due diligence is expected to take between four and six weeks.

Link announced plans to demerge PEXA following the receipt of a first offer from Carlyle and PEP.

This included an alternative bid where shareholders could take $3.80 cash and scrip for Link’s 44 per cent holding in the PEXA business.

Much debate amongst shareholders centres on the valuation of PEXA.

They have earlier suggested that more value from the company could be unlocked in a separately listed structure.

The latest offer, the consortium says, implies that PEXA is worth between $5.87 and $6.28 per share.

This is based on statements from shareholders such as Yarra Capital that they believed PEXA was worth between $2.5bn and $3bn.

The private equity firms now collectively have a 14.62 per cent stake in Link, after earlier each holding 9.65 per cent.

PEP is the previous owner of Link, listing the company at $6.37 per share, taking its market value to about $2.3bn, five years ago.

Its share price has been hit hard by the global health crisis, falling to $3.99 on the day before the bid was made public from about $6 at the start of the year.

Shares had moved as high as $9 in 2017.