Infrastructure investors Stonepeak, Brookfield and GIP are expected to circle Tabcorp’s $8bn lotteries unit when it is demerged on the ASX in the next few months.

Sources say the three parties are interested in the business as they look to put to work enormous piles of money raised from their infrastructure investors.

This week is shaping up to be big for Australia’s largest gambling companies, with talk Tabcorp is set to release documents offering greater details of its demerger plans.

It coincides with a highly anticipated move by the James Packer-backed Crown Resorts to release detailed documents for the proposed $8.9bn buyout of Australia’s largest casino owner by New York-based private equity firm Blackstone.

And on Monday, Star Entertainment announced that chief executive Matt Bekier had resigned after revelations at a royal commission-style inquiry to determine Star’s suitability to hold a NSW casino licence that the company disguised almost $1bn worth of gambling transactions as hotel charges.

Tabcorp could reveal the valuation metrics of its demerger in the next few days.

Corporate activity is expected after the Tabcorp demerger unfolds.

Last year its wagering and media assets attracted attention from private equity suitors, which launched bids for that part of the business, but sources believe this time around it will be lotteries that parties will make offers for.

The lotteries unit can be considered “core-plus” infrastructure.

It has the same low-risk earnings profile as more traditional infrastructure assets.

And it is the infrastructure investors that have plenty of money to spend right now.

Even private equity firms like EQT and Kohlberg Kravis Roberts have raised record amounts of money to spend in the space.

Brookfield’s purchase last year of US-based Scientific Games – a scratch lotteries service provider – for $7.7bn shows that investors are not deterred when it comes to investing in gambling-related companies despite the prominence of environmental, social and governance concerns in recent times.

Stonepeak, GIP and Brookfield have all been busy examining major takeover targets in the Australian market in the past year.

GIP has invested $4.1bn in Woodside’s Pluto Train 2, while Brookfield bought electricity company Ausnet for $10bn and Stonepeak competed to buy a half share in the smart metering company Intellihub, which Brookfield ultimately secured for about $1bn.

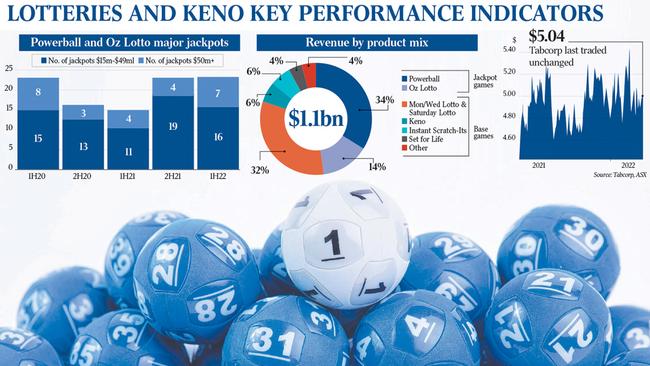

For the six months to December, Tabcorp’s lotteries and Keno revenue increased 10.9 per cent to $1.8bn while earnings before interest, tax, depreciation and amortisation were up 15.1 per cent to $358m.

While delivering its half-year result, Tabcorp said it was set to hold its first court hearing for the demerger in March or April, when it would also dispatch the scheme booklet for the demerger.

An investor vote and a court hearing are set to happen in May ahead of the demerger taking place by June.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout