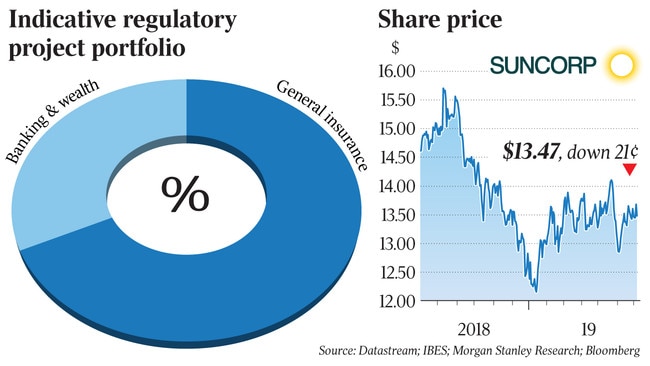

As the search continues for a new boss of Suncorp, speculation is mounting about a divestment of its banking arm, with a demerger seen as a more likely option than a sale.

The departure of former boss Michael Cameron was announced in May, and one likely internal candidate to replace him is former chief financial officer and current acting chief executive Steve Johnston.

But once the new boss of the financial group is appointed, the thinking is that one of the first priorities of the business will be a demerger of the banking operations.

Suncorp would probably retain a stake in the demerged bank, which is expected to be a drawcard for an insurer when it comes to securing business.

Following last year’s royal commission into the financial sector, regional banks are facing stiff headwinds when it comes to securing new business. They also have to outlay capital updating systems that will no doubt prove costly.

One scenario that could unfold once the Suncorp bank has been demerged is that it will be purchased by a regional competitor or a private equity firm. German multinational insurer Allianz could also be a buyer of Suncorp when it is solely an insurer.

The move to demerge the bank was believed to have been a topic of discussion in the Suncorp boardroom at a meeting in May. Mr Cameron was thought to have been against a bank sale or demerger before he left.

DataRoom revealed in November last year that Suncorp had drafted in UBS to explore options for the Queensland lender and insurer’s banking operations, including a tie-up with Bendigo and Adelaide Bank.

However, proceeding with a spin-off or sale is not thought to be as easy as it seems, and has been considered many times in the past.

The challenge has been that a separation does not necessarily add value to the overall company and also that the Suncorp bank could suffer a credit rating downgrade if it was left without the insurance operation.

Fund managers are understood to be backing a sale or demerger of the bank because it would leave Suncorp as a pure-play insurer, which would make it a higher-returning business.

Suncorp’s banking operations for the 2018 financial year contributed $375 million in profit after tax to the overall business, which generated just over $1 billion in net profit.

Meanwhile, expectations are growing that health insurer Medibank will soon be on the hunt for a new chief executive, with an increasing number of sources pointing to the incumbent, Craig Drummond, as likely to be appointed as NAB chief executive.

A decision on the appointment is thought to be imminent.