IFM could make bid for APA if CKI is blocked

IFM Investors and Canada’s OMERs are expected to ramp up efforts in the months ahead to pull together a rival bid for the APA Group.

This is in the event that APA’s current suitor, CK Infrastructure, is blocked by regulators from buying the listed pipeline operator for $13 billion.

IFM, OMERs and Dutch pension fund partner APG lost the competition last week to buy a 51 per cent stake in Sydney Motorway Corporation that owns the $16 billion three-stage WestConnex Sydney motorway project.

Apparently, the IFM consortium was blown out of the water by the Transurban consortium that paid a massive $9.26bn for the toll roads.

The listed Transurban paid for its stake with cash — tapping the market for $4.2bn and launching a $600m placement to its bidding partners AustralianSuper and the Abu Dhabi Investment Authority.

Doubts have surfaced as to whether CK Infrastructure will receive clearance from the Foreign Investment Review Board and the Australian Competition & Consumer Commission to buy the APA Group, particularly with the Labor Party likely to be in power next year.

Investment bank UBS (which also advised Transurban on its acquisition of WestConnex) is believed to be on standby for IFM should it decide to lob a bid for APA with other parties.

The thinking is that a takeover of the nation’s most dominant owner of pipeline assets by a consortium with an Australian investor is likely to be more politically palatable than one from a consortium that is entirely foreign owned.

Analysts say IFM is only likely to bid for APA if CK Infrastructure is entirely blocked from acquiring the company.

The question is at what price would IFM make an approach and at what price the APA board would have comfort granting due diligence.

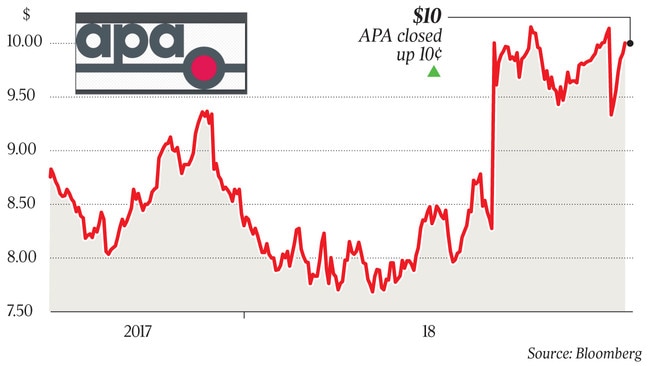

The thinking is that CKI was only granted due diligence because the company put forward such a knockout offer at $11 per share and there is no one who believes IFM could pay close to that price. APA shares last traded at $10 as investors remain doubtful that a transaction will proceed.

Meanwhile, IFM’s WestConnex consortium was said to be a long way behind Transurban in terms of its bid price for the toll road project and may have even tried to revise its offer at the final hour. However, this was not confirmed by the parties involved.

It is also worth noting that the Transurban equity raising has proved to be a lucrative assignment for the banks involved — UBS, Morgan Stanley and Macquarie Capital.

For underwriting the Transurban rights issue, the trio appear to have made an eye watering $68 million in fees.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout