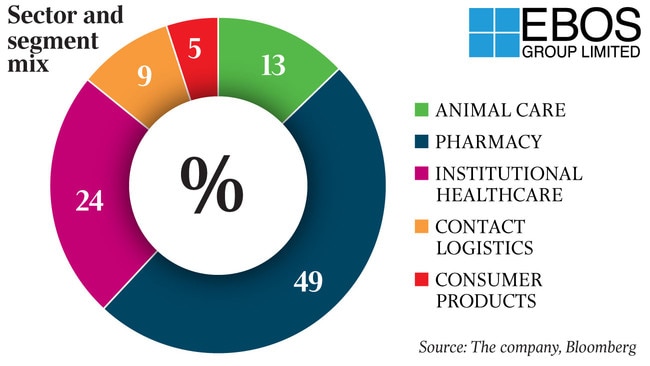

Australia’s largest pharmaceutical products wholesaler EBOS Group has flagged that it plans to embark on acquisitions in the aftermath of the coronavirus pandemic disruptions.

On its agenda are bolt-on acquisitions in Australia and New Zealand, although chief executive John Cullity has not ruled out deals in Asia.

Mr Cullity said smaller listed rival Paragon Care was not on the company’s sights for a deal. This followed talk in the market that suitors were circling Paragon Care.

The Real Pet Food Company, which was previously owned by private equity firm Quadrant and had earlier been tipped as a float prospect, would be too large for EBOS, with some market watchers estimating its value could be about $1bn.

EBOS, which is listed in Australia and New Zealand, has a market value of $3.4bn.

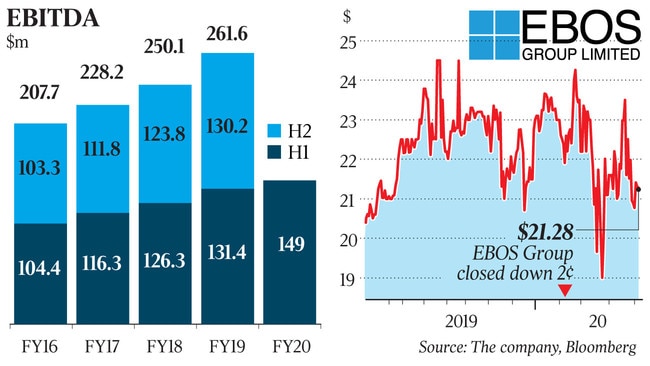

After raising $175m a year ago, it has $392m of net debt, with debt equating to 1.4 times earnings before interest, tax, depreciation and amortisation.

For the half year, EBOS had a 15.8 per cent lift in its net profit to $84.2m. At the Macquarie Australia Conference presentation on Tuesday, Mr Cullity said the company was growing organically at about 3 per cent and that earnings would grow at a higher level through acquisitions.

One area of opportunity is in the medical devices area. There is a pipeline of opportunities, according to Mr Cullity.

With devices, the company has opted to build the business internally after missing out on acquiring the privately held Device Technologies in a sales process in 2018 that saw the business sold to Navis Capital.

Mr Cullity said pet foods and treats performed strongly in recessionary conditions, although he failed to offer any insight into what the months ahead would look like for EBOS from an earnings perspective.

The group sells pharmacy products wholesale to more than 7000 hospitals and has a major contract with the Chemist Warehouse, which itself has aspirations for an initial public offering.

Mr Cullity said local pharmacies were performing better than those within CBDs and malls.