Distressed investors buying up debt in the Bluewaters Power Station in Western Australia are likely hoping the company can gain control of the Griffin Coal mine that provides fuel for the asset, according to market analysts.

Numerous lenders have now offloaded debt in the Bluewaters Power Station ahead of its August 4 refinancing deadline, with groups including Oaktree Capital Management, SC Lowy, Deutsche Bank and Bank of America, Davidson Kempner and possibly US investor Elliott all among the acquirers.

The coal fired power station’s owners, Sumitomo and Kansai Electric, have been in search of fresh funds for the asset they purchased for $1.2bn in 2011 from Ric Stowe’s Griffin Group, which at the time was in the hands of KordaMentha because it had collapsed.

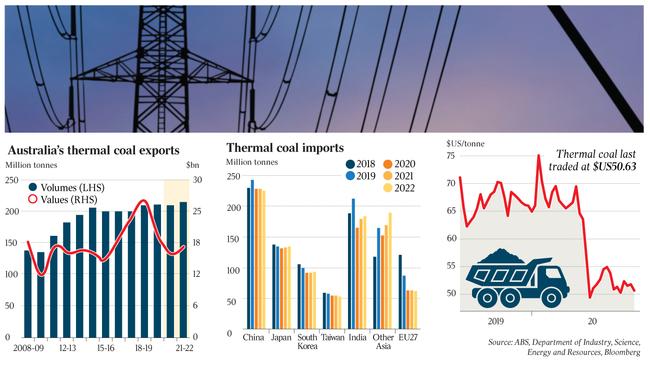

But banks are currently shying away from any assets with an exposure to thermal coal as concerns grow about burning the commodity on the impact on the environment.

However, the power station provides about 16 per cent of Western Australia’s electricity, and should it be shut down, prices in the state would likely escalate sharply.

The Griffin coal licence expires in 2023, but most expect that it will be extended by the state government.

The thinking is that hedge funds likely see an opportunity to capitalise on the cash flow the asset generates in the short term, but the viability of Bluewaters all depends on the cost of extracting the coal from the Griffin coal mine and the price for which it can sell its electricity.

The power purchase agreements for the asset are up for renegotiation in three to five years.

The Griffin Coal mine was purchased by Lanco Infratech in 2010 in a deal worth about $850m and currently has loans worth about $1bn to India’s ICICI bank, which has guaranteed the debt.

The mine’s parent company is in receivership through PwC and up for sale, with the cashflow from the mine not enough to service the debt.

In reality, it is thought that the coal mine is worth little more than $100m as renewable energy becomes the way of the future for electricity.

Some believe that distressed investors will be working to convince the lenders to the mine that they write the value down to about 10c in the dollar or even effectively give the mine to the Bluewaters Power Station owners.

It is thought perhaps that such offers have so far been made and rebuffed, but with little interest expected in the asset, many believe offloading the mine for a minimal sum is the only likely outcome.

Sumitomo, meanwhile, had been offering lenders on Bluewaters Power Station between 64c and 66c in the dollar.

But Oaktree purchased $36m of the debt for 71c in the dollar from ANZ and others, including Westpac, NAB, Societe Generale Group and Bayern among others have since sold for what is likely to be a similar price.

The face value of the debt pile is about $369m.

Analysts believe that groups such as Oaktree would be taking the view that if the coal can be produced cheaply, the power station could be profitable.

The Indians owners of the Griffin Coal mine originally bought the asset in 2010 with the plan to outlay an additional $500m for an expansion, but they never obtained the approvals for an expansion to happen.

Its plan was to export the coal to India.

The Bluewaters power station at Collie, 200km south of Perth, was built by Griffin Energy in 2009 and has a total electricity generation capacity of about 430 megawatts.

Sumitomo is working with Houlihan Lokey and Clayton Utz, McGrath Nicol is aiding the lenders along with law firm G+T, while Japanese bank MUFG is working as the financial adviser to the Bluewaters company.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout