GrainCorp rethinks its future as drought hits

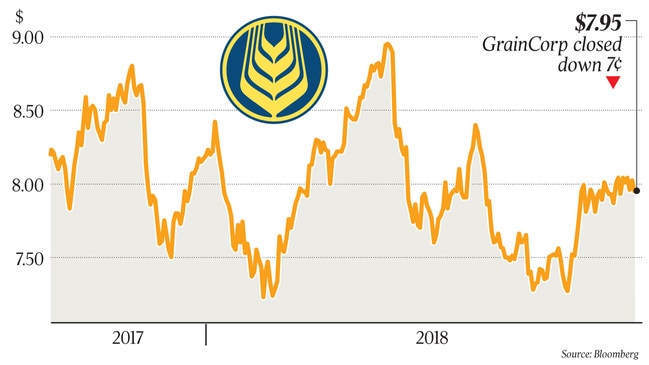

The lingering east coast drought is taking a toll on GrainCorp’s share price, and some wonder if now is an opportune time for change to ensure it remains in a structure that reflects its true value.

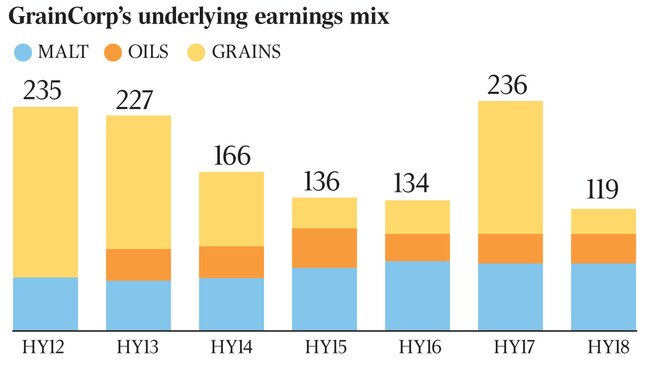

First there is the malt business, which is a strong performer for the group. One plan could be to beef up that part of the business.

Next there are the company’s terminal assets, which could be demerged or sold off to infrastructure investors — a move that has been mooted before.

What plan GrainCorp will choose remains unclear.

Plenty of scenarios are being discussed around the boardroom table.

Australia’s largest grain handler could acquire the $US1 billion of global malt assets from Cargill, with the listed company believed to be exploring an acquisition.

Cargill is one of the world’s biggest agricultural trading houses and is “exploring options” for its malt unit that may result in a sale, according to a Bloomberg report.

The Australian malt assets owned by Cargill are thought to be worth a few hundred million, but it is not out of the question that GrainCorp would buy the entire global operation.

The business supplies products to brewers under its Cargill Malt, Prairie Malt and Joe White Maltings brands.

Cargill is said to have remained bearish on malt in the past on the back of the global consolidation of beer companies, but it’s a strong performer for GrainCorp.

Meanwhile, GrainCorp’s terminal assets have been on the radar of deal-makers in the past.

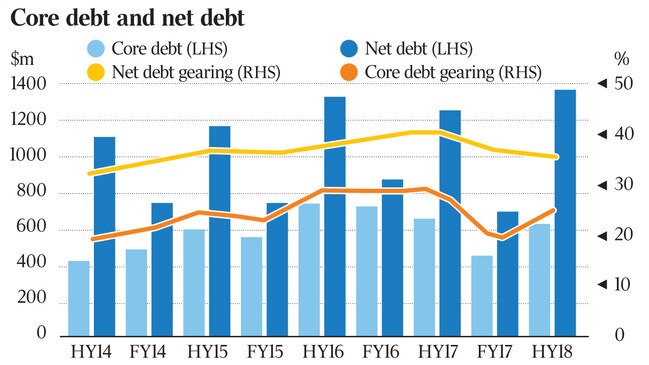

One of the challenges for the $1.8 billion listed grain logistics provider is that it requires funds to maintain the terminals, and the pitch at the time of the $3.4bn mooted takeover of the company by Archer Daniels Midland in 2013 was that the deal was supposed to provide the money needed to carry out that work.

GrainCorp owns seven bulk terminals on Australia’s east coast and 13 liquid terminals in Australia and New Zealand.

However, only the best terminals would sell for top dollar, with the in-country assets unlikely to attract eager buyers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout