GrainCorp preparing to make restructure announcement

GrainCorp could be about to tap the market for equity as early as today as speculation mounts that the group has been contemplating a restructure or some sort of acquisition.

There are suggestions in the market that the country’s largest grain handler could be coming out with a major announcement surrounding a transaction, but exactly what it involves remains unclear.

Speculation emerged in the past few months that Cargill’s US$1 billion-odd global malt operations are up for sale through Credit Agricole and expectations have been growing that GrainCorp is a buyer.

Chief executive Mark Palmquist has been eager to embark on a bold move for some time and it is thought that its mystery move involves adviser Macquarie Capital, while Credit Suisse has also had a longstanding relationship with the company.

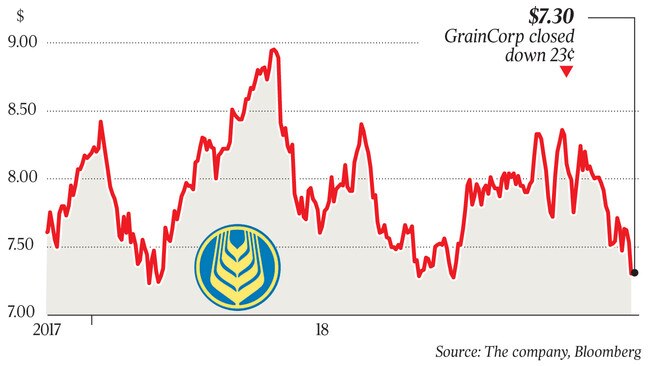

Some suggest that it would be brave for GrainCorp to embark on a transformational transaction at a time when its share price is suffering due to drought-related poor performance.

But the thinking is that the company’s management is executing its strategy well so it has credibility.

The stock trades around its net asset value but shares closed at $7.30 on Friday — down from almost $9 in April.

Differing opinion also exists as to whether GrainCorp is a buyer or a seller of assets.

Some believe that its terminals — worth hundreds of millions of dollars — could be for sale and the major announcement may relate to that but the company earlier had dismissed suggestions that they would part with the assets.

There would also be concern should asset sales emerge given that the market is weak.

Macquarie analysts estimated earlier this year in a research note that its storage facilities are worth $480 million and its bulk liquid terminals $277m.

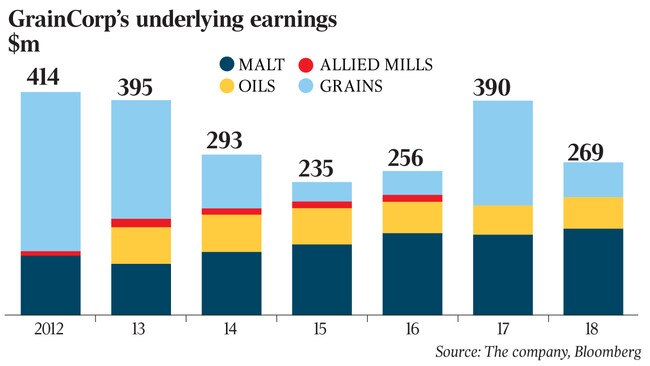

Only this month, the company was talking up the prospects of its malt operations, which it said staged a “positive performance” for its 2018 financial year as it continued to benefit from strong demand from distilleries and conventional and craft brewers despite being affected by high energy prices in Australia.

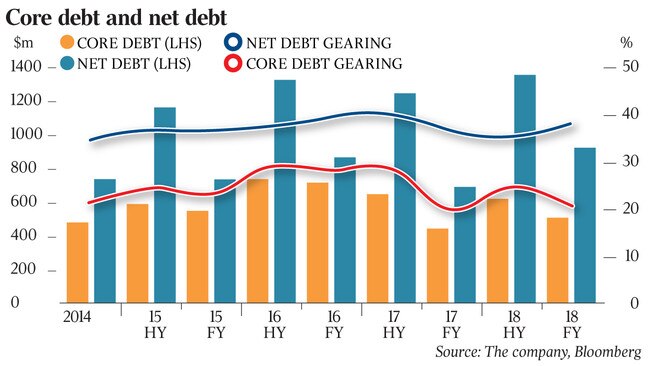

Macquarie analysts also said in a recent note that they expected its malt operations to stage a 9 per cent uplift in its earnings before interest, tax, depreciation and amortisation growth for the 2019 financial year and its balance sheet was in a reasonable shape with debt levels below its 45 per cent target, at 38 per cent.

The analysts said they expected GrainCorp to take a close look at the Cargill malt business, and that part if not all of the operations were a fit.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout