The nation’s largest freight rail company, Aurizon, has had a busy year behind the scenes examining possible acquisition opportunities, and it is understood one of them is GrainCorp.

The $1.4bn GrainCorp is the nation’s largest grain handler, operating across the east coast.

This month it upgraded its 2021 financial year net profit guidance to between $125m and $140m on the back of favourable weather conditions, bouncing back from one of the country’s worst droughts on record.

DataRoom understands that the $7.4bn Aurizon mulled an acquisition in partnership with West Australian grain growing co-operative CBH Group.

The understanding was that Aurizon was to manage GrainCorp’s infrastructure while CBH would handle the operational side of the business.

GrainCorp has seven ports on the east coast and a joint venture port under construction in Vancouver, Canada.

CBH has had interest in moving to the east coast in the past but was blocked by its stakeholders and has since been moving to take costs out of its supply chain.

However, on the agenda for Aurizon is a potential acquisition of the One Rail Australia business, formerly known as Genesee & Wyoming Australia, which has been placed on the market by Macquarie Infrastructure and Real Assets.

The business has been on the market for some time through Credit Suisse and Macquarie Capital and it is understood Aurizon’s interest centres on at least the non-coal haulage operation and potentially the coal haulage assets that are being offloaded separately.

The non-coal-related unit generates about $220m in annual revenue and more than $100m in earnings before interest, tax, depreciation and amortisation and it may be worth about $1bn.

On offer are 2500km of rail tracks between South Australia and the Northern Territory, along with intermodal and bulk haulage operations with customers such as Toll, Linfox and Coles.

Aurizon, Qube and Pacific National are believed to be among the parties competing for the non-coal business, which is yet to call for formal bids.

Some also question whether Qube could be in its sights for a potential merger transaction, although Aurizon says no talks have taken place with its rival.

Qube counts as its chairman Allan Davies, who previously worked with Aurizon boss Andrew Harding when both were coalmining general managers at Rio Tinto.

An acquisition of its $5.7bn rival could be one way to reduce its exposure to coal operations proportionately.

Others believe Qube would be spearheading a deal, given it is debt-free with $800m of cash on its balance sheet following recent asset sales.

Yet most believe investors would not want Aurizon’s exposure to coal haulage.

Qube reports its results next Thursday, and a line of questioning is expected to be whether it will embark on acquisitions or return cash to investors with the proceeds.

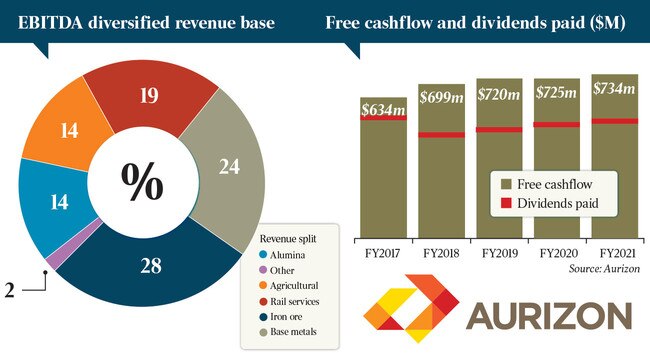

Aurizon’s result delivered last Monday showed earnings and sales growth have been flat over the past year, as it delivered $607m annual net profit.

Of its overall earnings before interest, tax, depreciation and amortisation, it generated $533m from coal haulage, $140m from its bulk port operation, which it hopes to grow, and $849m from its network business.

It has hopes of generating between $1.4bn and $1.5bn of EBITDA this financial year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout