The $1bn sale of the Asia-Pacific glass container manufacturing division of Owens-Illinois could see its Australian operations in the hands of a global buyout fund eager to put large amounts of money to work.

Investment bank Goldman Sachs is handling the sale of Australia’s largest glass manufacturer, Owens-Illinois, or O-I as it is known, as it also helps one of the world’s largest container glassmakers with an international strategic review, as exclusively revealed online by DataRoom on Wednesday.

Expectations so far are that global private equity groups such as The Carlyle Group, TPG Capital, Bain Capital, Kohlberg Kravis Roberts, Blackstone and Brookfield are the most likely contenders for its Asia Pacific arm.

However, some question whether privately held Australian packaging giant Visy Industries, which is run by Anthony Pratt out of Melbourne and has international annual sales worth more than $5bn, will be in the mix, or the European base rival Ardagh Group.

The outcome could be determined by the willingness of Owens-Illinois to sell to a competitor.

On the face of it, an offshoot of Australian-based global packaging giant Amcor, Orora, looks to be the most logical buyer.

But Orora could face Australian Competition & Consumer Commission issues, given that it is among the largest cans, glass and cardboard manufacturers in the country.

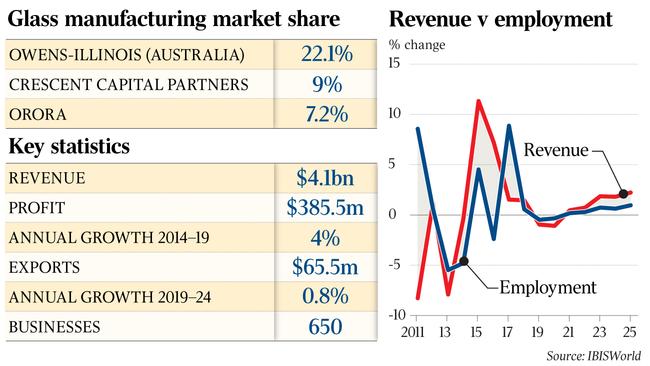

Orora, which was previously called Amcor Glass before it was separately listed, generates 70 per cent of its revenue in Australia and holds 7.2 per cent of the glassmaking market, according to IBISWorld, while O-I holds 22 per cent.

Goldmans appears to be growing used to helping major corporations offload divisions, with the US-based investment bank recently working for Campbell Soup Company on the sale of its international arm, which included the iconic Australian biscuit company Arnott’s. KKR bought Arnott’s in a $3.15bn transaction two months ago.

O-I is listed in New York and is one of the largest glass- container manufacturers in the world.

In 2018 it reported $US6.9bn in annual net sales and segment operating profit of $US945m on the back of higher prices but lower glass-container shipments.

Estimates are that it generates about $100m of earnings before interest, tax, depreciation and amortisation for its Asia Pacific division and it would sell for about $1bn.

According to its public accounts, its Asia-Pacific operations generated $US44m of operating profit during 2018, which was $US21m below the prior year.

Founded by Michael J. Owens, the global company is based in Ohio and is also the largest manufacturer of glass containers in North America, South America and Europe.

It is examining opportunities to divest assets as it wrestles with a $US16bn ($23.7bn) debt pile and at a time when the company faces challenges with respect to a stronger US dollar.

High energy costs have also hurt its Australian manufacturing operations.

According to IBISWorld, the Asia-Pacific operations of O-I account for about 10 per cent of the group’s global sales, and in Australia, it operates 12 glass plants in locations including Adelaide, Brisbane, Melbourne and Sydney.

Operations also exist in New Zealand, China and Indonesia, along with China, Malaysia and Vietnam, where it has joint venture operations.

In previous years, O-I has reduced its permanent manufacturing footprint in Australia and lost market share in the wine and beer-bottling segments to Orora.

As a result, it has reduced its production capacity to better reflect market conditions.

Reporting its latest full-year earnings, O-I said glass containers shipments for Asia Pacific were down nearly 3 per cent for 2018 compared with the prior corresponding year, adding that an asset improvement project in the region drove operating costs higher.

Founder Mr Owens was credited with making the first automated bottle-making machine and he merged his Owens bottle company with the Illinois Glass Company.

The group previously made plastics but those operations were sold 12 years ago. In 2015, O-I bought Mexican food and beverage glass container company Vitro for $US2.15bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout