ANZ is understood to be striking a deal with French payments company Worldline to take over the operations of its credit card payments infrastructure in what some believe values the business division at about $1bn.

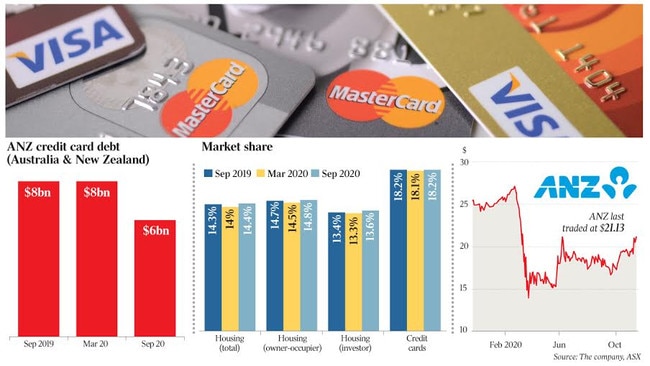

Experts believe the move is likely to be the first step in a retreat from the credit card business for ANZ as major competitors such as Afterpay and Zip Co gain a larger foothold in the consumer credit market.

Worldline generates about €2.3bn ($3.7bn) of annual revenue and has recently been on the acquisition trail. It used to count French information technology company Atos as its main shareholder before it recently sold down its stake in the business.

This year, Worldline bought the world leader in the payment terminal market, Ingenico, for €7.8bn, before acquiring GoPay, an online payments specialist in Eastern Europe.

As well as merchant services, the business is also involved in financial services, accounting for about 45 per cent of its overall operations and mobility and transactional web services, which accounts for about 18.5 per cent. On offer is believed to be ANZ’s physical Eftpos payment services, machines and processing services.

Merchant services divisions in banks provide the payment components for non-cash payment modes both online and offline, including the payment infrastructure and merchant accounts.

Market analysts say ANZ is not thought to be a leader in terms of its Eftpos machines and the sale comes as fewer terminals are used as more consumers switch to shopping online.

Some believe ANZ’s strategy over time is to exit the credit card market and outsource services for its customers to another party, providing only mortgages for retail customers.

ANZ’s strategy has also been to steer well clear of the “buy now, pay later” market, unlike its competitors CBA, which has struck an agreement with US firm Klarna, and Westpac with Afterpay.

This month, ANZ chairman David Gonski told The Australian he believed the BNPL market would face scrutiny over time.

A potential move out of credit cards comes after ANZ has staged an exit from life insurance, wealth management and car dealer finance in recent years.

ANZ completed the $2.85bn sale of its Australian OnePath Life insurance business to global giant Zurich in 2019, while IOOF bought the pensions and investments arm of the wealth management business for $850m in the same year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout