Forensic software company Nuix is believed to be in the crosshairs of one of its major competitors in the US, with some now betting that the $2bn-plus company will be sold rather than listed.

It is understood that two rivals, Palantir Technologies and Relativity, have been closely examining the business that Morgan Stanley analysts believe is worth between $2.4bn and $3.4bn including debt.

However, it is now thought that Relativity is closing in on Nuix, as equity investors describe the business as a quality offering that is likely to be richly priced, despite Palantir also considering an acquisition.

Earlier, a range of private equity firms had been looking at Nuix, and two new names to emerge are Baring Private Equity and Marlin Equity Partners.

Palantir carries out sensitive data analysis in the US and is far larger than Nuix, with a market value of about $US17bn ($24bn).

However, Relativity is a similar business to Nuix, where the pair have more customer overlap, and both generate annual revenue around the $200m mark.

It is understood Relativity is worth somewhere between $3bn and $5bn and also had plans to list as a public company.

The thinking is that bringing the companies together would create large synergies, and the understanding is that the plan for Relativity is to buy Nuix before heading to the boards for well in excess of $2bn.

Working on the float of Nuix, which is 65 per cent owned by Macquarie Group, is Macquarie Capital, while Morgan Stanley is working on both the IPO and the trade sale in a dual track process.

Fund managers say that locking in time to meet with Nuix management has been not been straight forward, which may be an indication that a trade sale could be the preferred exit option.

Details have not been offered about the size of an IPO should it head to the boards.

However, Nuix has appointed Jeffrey Bleich as chair and DataRoom understands former government cybersecurity adviser Iain Lobban has been hired as a director.

Nuix was said to be preparing to lock in investors for a cornerstone process in the coming days.

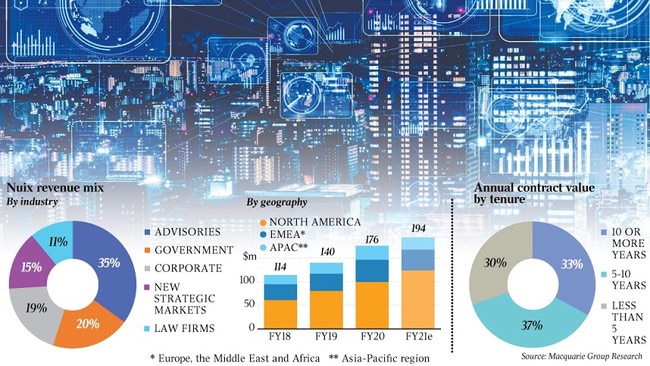

The pricing estimates from analysts at Morgan Stanley value the company at between 12.5 and 17.5 times forecast sales for the 2021 financial year of $194m.

The sales are said to be growing at about 19 per cent annually over three years on a compound basis.

The company generated $60.6m of earnings before interest, tax, depreciation and amortisation for the 2020 financial year and the EBITDA is expected to grow to $64.1m on a annually proforma basis.

Nuix has software that allows users to process and make sense of huge amounts of data and provides services to governments, advisory law firms and larger corporations around the world.