It may have taken Woolworths two years to sort out its demerger of the Endeavour Group pubs and drinks business, but already the clock is ticking on another part of the deal.

The big question is how long billionaire pub baron Bruce Mathieson will stay in the soon to be listed entity.

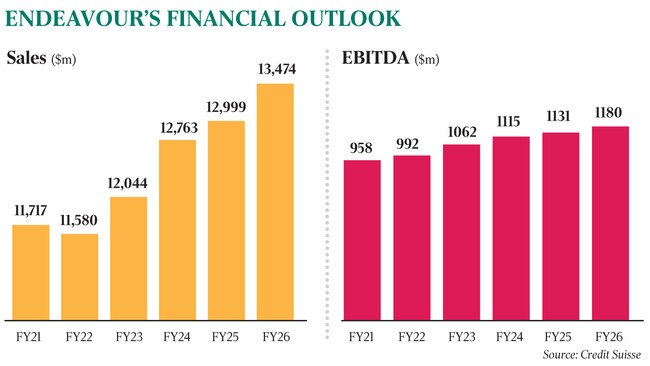

Endeavour shares are set to commence trading on the ASX on Thursday on a conditional and deferred settlement basis after Woolworths shareholders overwhelmingly approved the $12bn demerger at a meeting on Friday.

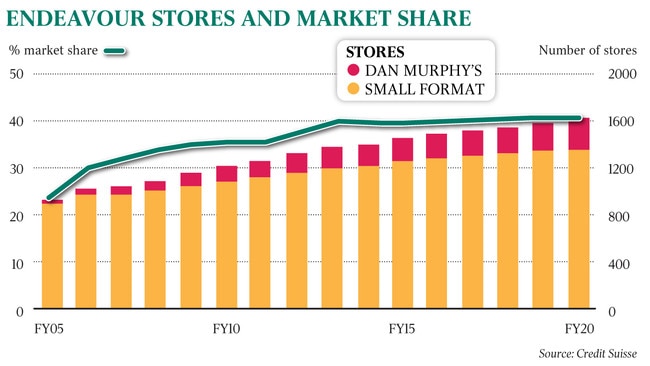

Mathieson is Woolies’ long-time pubs partner, with he and the supermarket giant having established what would become ALH Group after the billionaire famously met ex-Woolworths boss Roger Corbett at the corporate hospitality at the Sydney Olympics in 2000.

That marriage combined Mathieson’s legendary pubs expertise, built up over four decades, with Woolies’ bottle shop businesses, yet investors may wonder just how long both parties will remain involved.

When it lists Endeavour will instantly become a top 50 company on the ASX.

Some estimates have Mathieson holding a stake worth more than $1.8bn for his 14.6 per cent shareholding in Endeavour, the same percentage Woolworths will maintain.

Yet the demerger documents released a couple of months ago show that neither Mathieson or Woolworths have to hang around for long.

“When the Demerger is implemented, Woolworths’ and BMG’s (Bruce Mathieson Group’s) shareholdings in Endeavour will not be subject to any escrow or to any retention arrangements,” the group’s demerger booklet reveals.

To be fair, there is a disclaimer of sorts for both parties in the document.

“BMG regards its shareholding in Endeavour to be a long-term investment,” it states.

It also says: “Woolworths intends to retain a substantial shareholding in Endeavour so long as it considers it is in the interests of Woolworths shareholders to do so.”

But Mathieson is famous for sniffing out value in a deal and making his money “on the way in” as he likes to say, by picking up assets at decent value at the start and later selling at the top of a market.

Private equity outfits were already crawling over Endeavour before management finally announced in May that the demerger was to go ahead. It is likely they and other big institutions will keep an eye on what, if anything, Mathieson may choose to do with his shares.

As with most of his business dealings, Mathieson is likely to keep his cards close to his chest when it comes to his Endeavour stake. But as with many self-made entrepreneurs on The List – Australia’s Richest 250, he is no fan of the spotlight that comes with being involved in listed companies. Watch this space.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout