Investors put their hands in their pockets for $665m on Wednesday to recapitalise financially stressed Australian listed companies in what has been one of the business days for equity capital markets bankers since the Coronavirus crisis gripped the nation a fortnight ago.

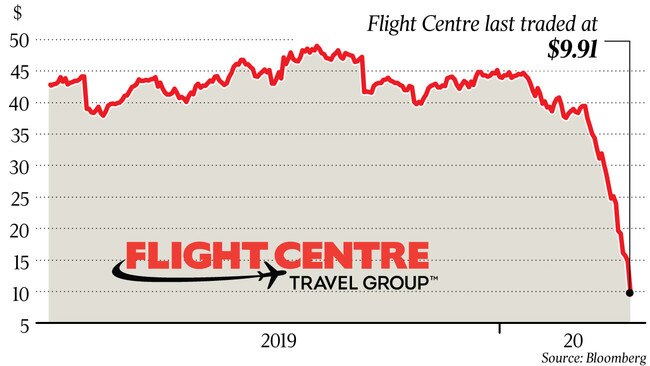

Now, many are pointing to Flight Centre as one of the next cabs off the ranks. Expectations are mounting that Flight Centre will tap the market next week, backed by advisers Macquarie Capital, UBS and Luminis Partners.

A raising will help the company endure more than six months of store closures, with the industry reeling under a ban on recreational travel to control the spread of COVID-19.

While a few companies have made desperate raisings have so far to keep their businesses afloat, there may now be a surge, with the new rules n placements coming into force.

The rules enable companies to raise 25 per cent of its market cap in new equity rather than the 15 per cent normal limit.

Both Kathmandu and Webjet offered major discounts to their equity raisings.

Kathmandu on Wednesday tapped the market for $NZ207m ($201.5m) at 50c a share, comprising a $NZ30m institutional placement and a $NZ177m 1.2 for one entitlement offer.

The raising is at a 51 per cent discount to Kathmandu’s last closing share price of $NZ1.02.

Institutional investors were said to have been disappointed by the move, only months after the company took on more debt and tapped the market for $NZ177m to buy surf wear brand Rip Curl for about $350m.

The company’s largest shareholder Briscoe Group, the retailer across the Tasman headed by Rod Duke, with an interest of about 16 per cent, did not support the capital raising and sat on the sidelines.

The raising was fully underwritten by Credit Suisse, Jarden, Craigs and Forsyth Barr.

Meanwhile, Webjet announced another attempt to tap the market on Wednesday, but at what is thought to be at a lower price than when it tried a week ago.

The online travel agency said it would raise up to $332m at $1.70 a share.

According to a term sheet sent to investors, the company has launched an institutional placement and a partially underwritten one-for-one entitlement offer to secure at least $275m.

The entitlement offer will secure between $174m and $231m, with a bookbuild held to obtain the funds on Wednesday.

The fully underwritten placement was to secure $101m by selling down 21.9 per cent of the company.

Goldman Sachs, Ord Minnett and Credit Suisse are working on the partially underwritten recapitalisation that will see shares sold at a 53.7 per cent discount to Webjet’s last closing price of $3.67.

Last week, it was said that Webjet was trying to raise between $250m and $300m of funds at $2 a share. Bain Capital and Kohlberg Kravis Roberts were exploring a potential recapitalisation, but that is now understood to be off the cards for now.

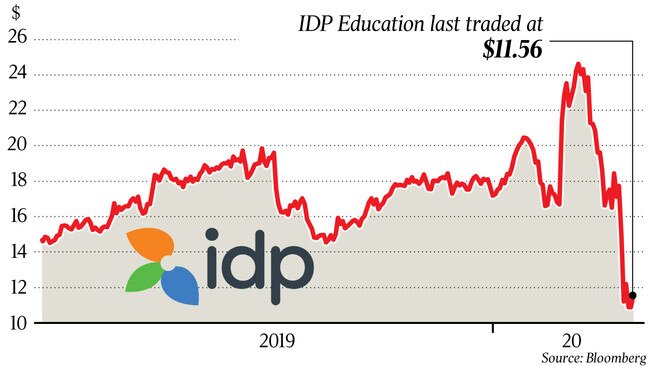

IDP Education was also asking for $190m from investors on Wednesday to help it withstand the economic impact of COVID-19 disruptions.

However, it later upsized the raise to $240m on the back of strong demand.

The fully underwritten raise through Macquarie Capital was at a slim discount to the company’s last traded share price of $11.56, with shares sold at a 7.9 per cent lower price at $10.65 each.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout