One or two parties will soon be shortlisted for the sales process of Lendlease’s services and engineering division as Morgan Stanley and Gresham continue talking to suitors.

It is expected that the operations will sell for hundreds of millions of dollars despite being subject to major writedowns.

Lendlease has offered a pre-tax $500 million provision for underperforming projects.

These include the Gateway Upgrade North in Brisbane, which has been operational since March, and Brisbane’s Kingsford Smith Drive and Sydney’s NorthConnex M1/M2 Tunnel projects, which are more than 85 per cent complete and expected to be finished next year.

The company earlier provisioned for 450m-$550m of restructuring costs before tax.

Lendlease boss Steve McCann said last week that the company believed the provision levels were appropriate and that several parties were undertaking detailed due diligence.

Several parties are said to be conducting due diligence on Lendlease’s services and engineering division, but not all are running to the same timetable.

Negotiations depend on how familiar they are with the business.

The first phase of the process involved suitors being offered information memorandums, but the process is now in stage two, where parties have received management presentations and have entered a data room.

A final shortlist will be drawn up, and parties given sensitive information about the process, including contracts.

During its annual results, Mr McCann indicated that the sales process for the division was progressing well.

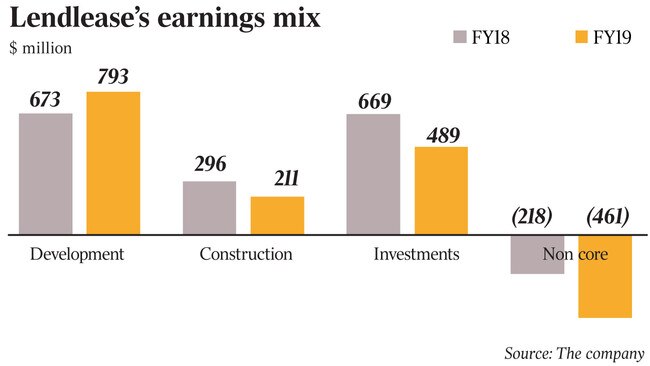

It came as the division posted a $337m loss for the financial year.

Some had earlier expressed scepticism that the division would find a buyer.

However, groups such as Sumitomo and South Korea’s Daewoo Engineering have been touted as potential suitors, along with the Chinese owner of John Holland.

The sale comes as a number of mining services assets come up for sale, including Next Capital’s Onsite Rentals, which is subject to a dual-track process through BAML, Macquarie Capital and Moelis.

Downer is selling its mining services operations after hiring Macquarie Capital to embark on a strategic review.

It comes after 18 months of speculation that the division was for sale.

DataRoom first revealed in April last year that the business could be on the block, with talk in the market that investment banks close to the company had been sounding out parties to test their interest in an acquisition.

Meanwhile, Seven Group Holdings has flagged that acquisitions could be on the agenda through its Coates Hire business, and it may be a suitor for operators up for sale.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout