Few surprises expected of Domain as it makes its market debut

The historic structure of the Fairfax empire will come to an end today when the demerged Domain begins trading as a listed company separate from the struggling publisher.

Shares in Domain, trading with the ASX code DHG, will be listed from noon and DataRoom understands the order book will start to be built by stockbrokers about an hour before.

Fairfax will keep 60 per cent of the Domain registry and existing shareholders have been given one share in the new company for every 10 shares held in Fairfax.

The valuations put on the Domain stock as a stand-alone entity hover about the $3.50 mark and equities traders last night said it was expected the stock should hit the market with those numbers.

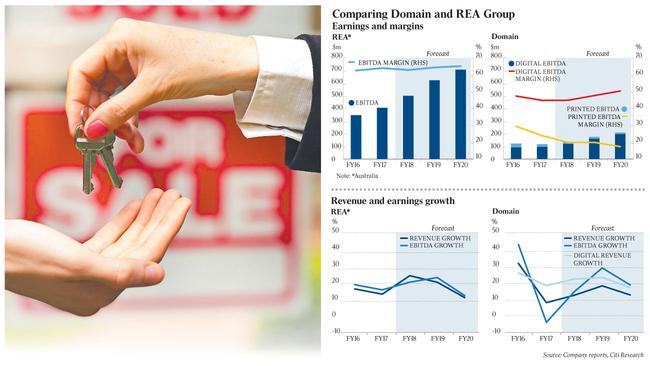

The performance of Wall Street overnight and the first few hours of trading will be crucial to Domain’s direction once it gets going. But observers said the relatively tight valuation range from analysts — Citi is at $3.50 and Credit Suisse is $3.52 — means there should be no major surprises when trading starts. UBS values Domain at $3.20 and has flagged that the separated company could be a private equity target.

The remaining Fairfax stock valuation among the analysts ranges from 63c to 74c and questions remain over the company’s future.

With Domain, considered the most valuable asset, spun off, the new-look Fairfax will hold the company’s newspaper, publishing and events assets. There is continuing speculation that Fairfax will be picked up by another media company but action is yet to start on that front.

The Domain demerger trading will be the first since South32 was spun out of BHP in 2015.

A report two years ago by Credit Suisse found that a new company generally performs well for at least six months after a split.

Going back to 2000, Amcor spun off PaperlinX, which now trades as Spicers; BHP demerged Arrium and then BlueScope; and in 2003 CSR carried out the Rinker transaction.

Before the global financial crisis, Westpac listed BT Investment Management and only offloaded its stake in the past two months. Tabcorp demerged Echo, which changed its name two years ago to Star Entertainment Group, and Westfield created Scentre Group in 2014 to operate its Australian centres.

Research examined 16 demergers from 2000 to 2015, showing little benefit to investors holding shares in the parent company for at least six months after the transaction. On the other hand, the demerged assets, or “new co”, that performed well in the first six months included BlueScope, Rinker, Treasury Wines and Trade Me, all posting solid gains.